Coping with grief and loss

Losing someone you love is a difficult experience. And in the midst of it all, there are legal and financial matters that need attention. Whenever you're ready, we're here to provide helpful resources for coping with loss.

Grief Care Resources

We encourage you to take advantage of these supportive resources as you begin your healing process.

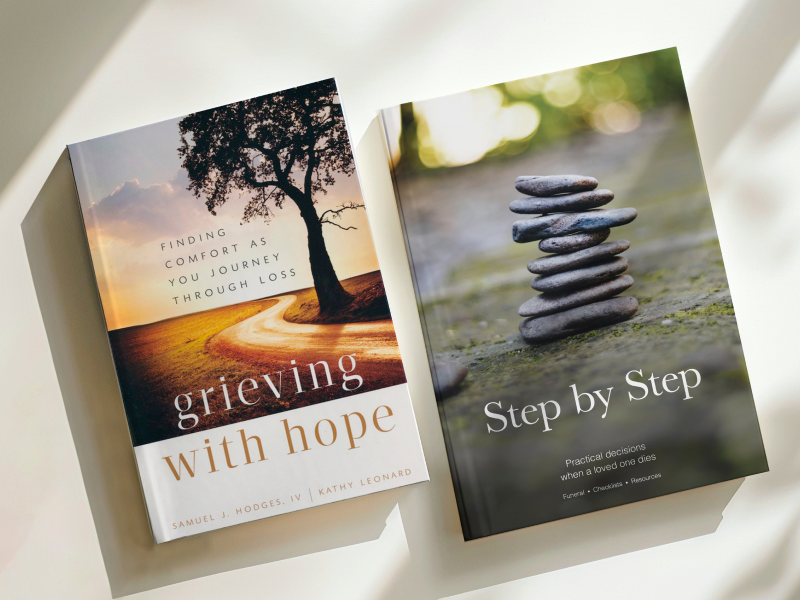

Grieving with Hope is a collection of short reflections that offer emotional and spiritual comfort in your time of loss. Step by Step helps you navigate the financial and legal logistics that come with the passing of a loved one.

Order Grieving with Hope

If you or someone you know has experienced a miscarriage, stillbirth or the loss of a newborn, this care package is designed to offer comfort and healing. It includes an adult-sized blanket and the Grieving the Child I Never Knew devotional, originating from the personal journey of author Kathe Wunnenberg.

Jan 24, 2022

We offer $5,000 grants to eligible clients who are coping with the loss of a newborn or stillborn child, to help with emotional healing, expenses or self-care.

The emotional toll of losing a loved one can make it difficult to think about practical matters. You can put off some tasks for a while, but it’s in your best interest to start addressing legal and financial matters early on.

We’re here for you when you’re ready

We can guide you through the decisions you’ll need to make to ensure assets – like retirement accounts and insurance policies – are distributed to the rightful beneficiaries.

Filing a claim

If your loved one owned insurance or investment products, you’ll need to file a claim as soon as possible. If any products were from Thrivent, you can file online, call920-628-6312 or notify your Thrivent financial advisor.

File a claim

We’re here for you when you’re ready

We can guide you through the decisions you’ll need to make to ensure assets – like retirement accounts and insurance policies – are distributed to the rightful beneficiaries.

Filing a claim

If your loved one owned insurance or investment products, you’ll need to file a claim as soon as possible. If any products were from Thrivent, you can file online, call

Frequently asked questions

Knowing which steps to take, and when to take them, can help you navigate the difficulties of losing someone special.

For help filing a claim with Thrivent, please refer to ourClaims frequently asked questions.

For information on estate planning, refer to ourTrust services frequently asked questions.

For help filing a claim with Thrivent, please refer to our

For information on estate planning, refer to our

Who can report the death of a Thrivent client?

Anyone can report the loss of a loved one. It does not need to be a beneficiary.

How do I report the death of a Thrivent client?

The loss of your loved one can be reported to Thrivent by completing and submitting this Report the death of a loved one online form. If you'd prefer to talk to someone at Thrivent about the process for reporting your loss, please contact us at 920-628-6713 .

What documents will be needed?

The type of documentation needed varies by the type of product and beneficiary designation. Most annuity and insurance claims will require a death certificate and beneficiary election statement (28E form).

Does the death certificate need to be mailed?

Claims over $500,000 require a certified death certificate to be mailed.

Claims $500,000 and under require a copy to be faxed or mailed.

Claims $500,000 and under require a copy to be faxed or mailed.

Where do I send or fax information to settle a death claim?

Our mailing address is:

Thrivent, Attn: Claims

4321 N. Ballard Rd.

Appleton, WI 54919

Faxes can be sent to 800-225-2264.

Thrivent, Attn: Claims

4321 N. Ballard Rd.

Appleton, WI 54919

Faxes can be sent to 800-225-2264.

Losing a loved one may cause you to think about your own finances, healthcare wishes and will. We're here to help, whenever you're ready.

Download your complimentary copy of ourWill and Estate Planning Guide.

Download your complimentary copy of our

Member benefits and programs are not guaranteed contractual benefits. The interpretation of the provisions of these benefits and programs is at the sole discretion of Thrivent. Thrivent reserves the right to change, modify, discontinue, or refuse to provide any of the membership benefits or any part of them, at any time.

You should only purchase and keep insurance and annuity products that best meet the financial security needs of you and your family and never purchase or keep any insurance or annuity products to be eligible for nonguaranteed membership benefits.

You should only purchase and keep insurance and annuity products that best meet the financial security needs of you and your family and never purchase or keep any insurance or annuity products to be eligible for nonguaranteed membership benefits.

7.2