Money Canvas®

A new relationship with money starts here

Three sessions. One coach. Zero cost.

Money Canvas® is a free financial coaching program that helps yousee where your money is goingbuild better financial habitsget more from your money

Free to try

Actually free

We’re a not-for-profit, which allows us to invest back in our communities—no hidden agenda or sales pitch. Because you shouldn’t have to spend money just to get better at saving it.

11K+

households served

since 2019

22K+

free financial coaching sessions delivered nationwide

91%

feel more confident about money decisions

$645

average monthly

savings of our users

One-size-fits-all course

One-on-one coaching

Work with the same Money Canvas® coach throughout the program. They help you reflect on habits, stay accountable, and make real progress towards your priorities.

Spreadsheets and jargon

Simple visuals

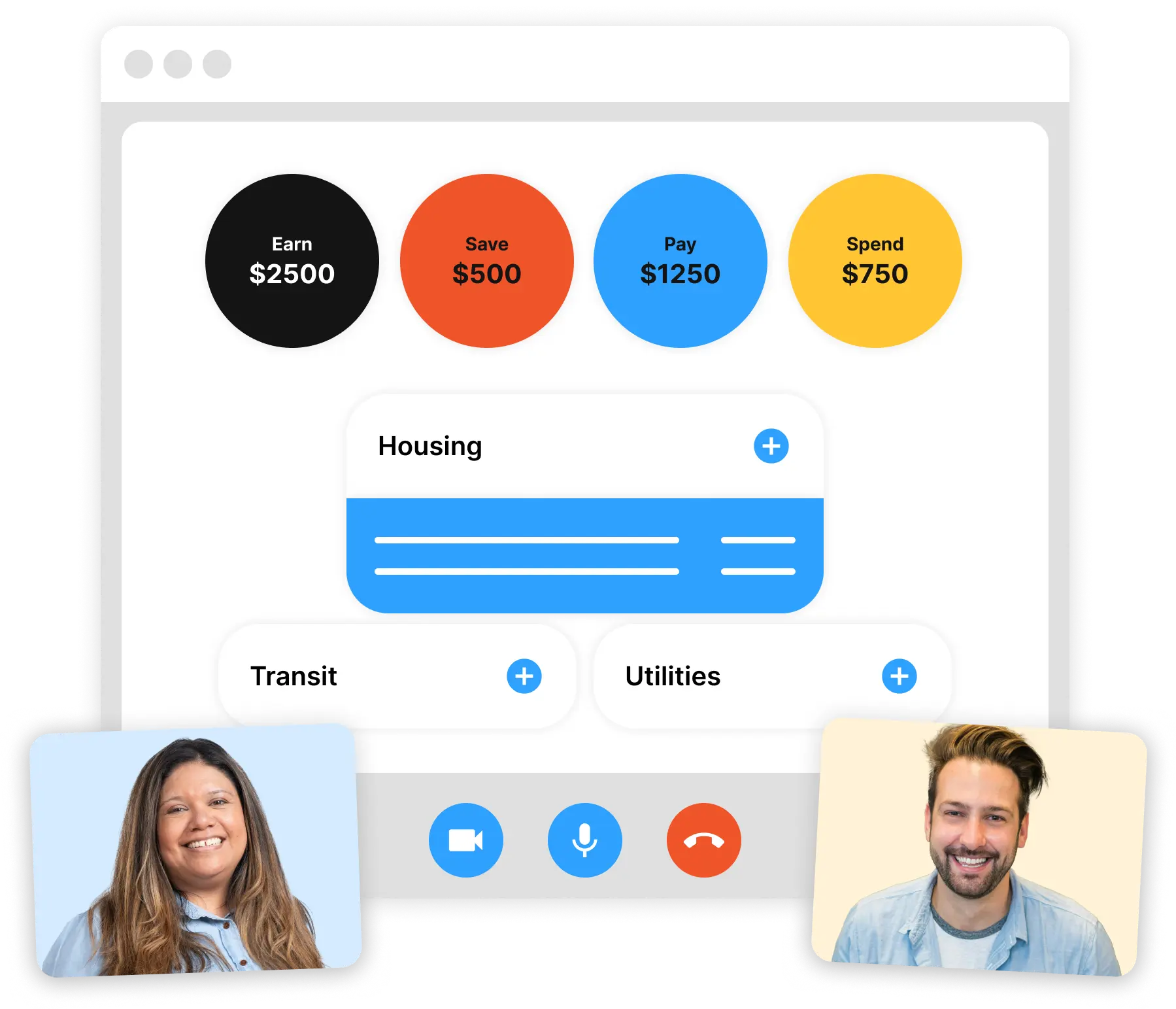

See your money in a new way. Our Color Theory is our signature budgeting method that breaks down your cash flow into simple color-coded categories.

Drastic changes

Bite-sized steps

Our financial coaching program is grounded in the science of behavior change. We start small—you’ll leave each session with an action plan and clear next steps.

Three sessions. One coach.

Our three-session program tackles one financial area at a time, with coaches to guide you each step of the way.

Session 1

| 60 min

Get organized

Meet your financial coach

Visualize your monthly budget

Reflect on money habits and what you want to change

Session 2

| 60 min

Get focused on bills

Break down monthly expenses

See how you’re doing against benchmarks

Uncover hidden ‘leaks’ and learn practical tips to address them

Session 3

| 60 min

Get focused on spending

Unpack spending habits and triggers

Design a plan to reduce one spending category

Start a month-long challenge to implement your new plan

Get started

Schedule your first of three 60-minute Zoom sessions and get paired with a coach.

Meet our financial coaches

Our coaches are money guides, not financial advisors. Their only job is to help you succeed on your terms.

With backgrounds in fields ranging from finance and banking to education and social work, our financial coaches are uniquely equipped to bridge the emotional and financial sides of money.

Real people, real stories

LaNette K.

LaNette is an author and business owner who lives in Colorado with her family. With the help of Money Canvas®, she paid off nearly half of her debt and transformed her approach to money.

“I get emotional thinking about it. It was a game of trying not to go into overdraft with my bank. I didn’t want to open up the books.”

LaNette

Money Canvas User

LaNette grew up in a family that didn’t talk about money. She’s not alone.

of Americans don’t discuss finances—not with their family (63%), friends (75%), or even their spouse/partner (46%).

Empower “Money Talks” Survey, June 2024

“Instead of just talking about numbers, we’re talking about life.”

Claudia

LaNette’s Money Canvas Coach

of Americans say finances are the number-one source of stress in their lives

Capital One CreditWise Survey, May 2024

of people feel more confident making financial decisions after Money Canvas

“I’m now empowered by my own money. Money Canvas changed my life.”

LaNette

Money Canvas User

Join the thousands who have used Money Canvas® tofind breathing room in their budgetspend less and save moreget finances under control

You might be wondering...

Yes, all Money Canvas sessions are entirely free of charge. There’s no hidden agenda, sales pitch, or bait-and-switch.

Thrivent's unique business model as a fraternal benefit society allows us to make investments that help people and communities thrive. From our humble beginnings in mutual aid to the membership-owned financial services organization we are today, we have a long history of placing purpose over profits. We created Money Canvas with the simple goal of helping people get better at saving—no strings attached.

Money Canvas coaches are professionally trained in cash flow management and the science of behavior change. All coaches complete a proprietary 5-week training program to deepen their expertise in personal finance as well as polish facilitation skills and internalize behavior change theories.

Money Canvas’ Color Theory is a proprietary method that focuses on topics not typically covered by financial advisors. Our coaches specialize in budgeting, spending and saving—and the art of making small changes to help you reach your goals—rather than providing investment advice or selling financial products, which requires different licensing.

Nope. Money Canvas coaches are not licensed to sell any financial products or provide investing advice. Our coaches do not manage your money or assets. Instead, we empower you with the tips and tools to make your own money decisions.

The difference between a financial advisor, financial planner, and financial coach is that:

- Financial advisors typically focus on investment management and insurance.

- Financial planners often take a broader approach, creating comprehensive financial plans.

- Financial coaches provide guidance on personal finance fundamentals like budgeting and debt management.

Financial advisors and planners often require licenses, while coaches may not. Fees vary based on the professional and services offered. Choose the one that best aligns with your specific needs and goals.

No, we’ll never ask you to link bank accounts or credit cards. Instead, your coach will ask you to self-report your monthly take-home pay and bills during your first meeting. Estimates are perfectly acceptable— and encouraged!

You might be thinking, "so... how will that be helpful?" We don’t need precise numbers or real-time financial activity to help you see the big picture. In fact, we think getting lost in dollars and cents is a big reason why most budgets don’t stick. In addition to being overwhelming and tedious, it can distract from the work of making real changes.

Yes, we care about data privacy and security as much as you do. You self-report your monthly cash flow, so we only collect the information that you are comfortable sharing with your coach. Anything you share in the session is confidential. We manage all information in accordance with Thrivent’s Privacy and Security Policies. We do not sell any of our users’ financial information. On occasion, we will analyze or share anonymized financial data for reporting or marketing purposes only.

We work at your pace, which is why you can schedule sessions around your own availability. That said, we typically ask users to wait 1-4 weeks between each session to allow sufficient time to complete assigned action items. On average, the program takes anywhere from 2 weeks to 2 months to complete, depending on your schedule.

No, Money Canvas does not offer debt or credit counseling.

We only go as far as helping you reduce spending (which may help you free up money to pay off debt balances) and clarifying the differences between the snowball and avalanche method.

Check out our article on practical tips to help you pay off debt.

Money Canvas is available in English and Spanish.

On our scheduling page, you can select your preferred language. If you select Spanish, you will only see availability for our bilingual coaches.

While we won't charge you, we ask that you provide at least 24 hours' notice by using the link in your appointment confirmation email to cancel or reschedule.

Short-notice cancellations and no shows are costly to Money Canvas, and impact our ability to continue providing coaching for free.

Email us at BoxMoneyCanvas@thrivent.com. We monitor this inbox Monday through Friday and will get back to you as soon as possible.

Money Canvas works with non-profits, small businesses, community organizations, and churches to make money coaching available to staff and/or communities.

If you are interested in bringing Money Canvas to your organization, please send an email to BoxMoneyCanvas@thrivent.com. We monitor this inbox Monday through Friday and will reply as soon as possible.

Looking for help with investing, retirement planning, or building a holistic financial strategy? Learn how Thrivent’s other products and services can help you, or find a licensed Thrivent Financial Advisor in your area.