Building resilience, trust amidst 2022’s challenges–all with a focus on you

Dear Thrivent clients:

I’m delighted to co-sign this letter with Cornell Boggs, the new chair of Thrivent’s Board of Directors.

Cornell is new to this role, but he’s not new to Thrivent. He’s been representing you, Thrivent’s membership, as a member of the board of directors since 2013. And having seen him in action, I can truly say he has your best interests at heart.

Collectively, all of us at Team Thrivent are here to serve you. You are the focus of all we do, and in 2022 we worked hard to deliver the experiences you expect. For example, we continued our efforts to provide you with holistic advice that is personalized and actionable; we offered engaging educational and generosity programs that 2.4 million people participated in; and we improved our digital experiences to make interacting with us easier.

When it comes to meeting your needs, our philosophy is to listen, learn and act. Listening proved to be especially critical amidst the challenges of 2022.

Inflation and market volatility filled the headlines, and we know many of our clients struggled through the uncertainty of the year. But our financial advisors were right by your side, helping you weather uncertain times by listening and providing practical advice.

We, like you, showed resilience in the face of a challenging economic environment, and we ended the year with much to celebrate:

Financial strength and stability: For more than 120 years, Thrivent has taken a disciplined approach, preserving and building our financial strength. As an indicator of our enduring strength and stability, our adjusted surplus grew to $16.6 billion in 2022,* the strongest capital position in Thrivent’s history.

Record dividends: Our financial strength also means that our members get to share in our success. In 2023, Thrivent will distribute $400 million to our clients in the form of insurance product dividends and credited rate enhancements—a record year that is 37% higher than our 2022 distributions. (Dividends are not guaranteed.)

Mutual fund performance: 50% of our mutual funds have four or five stars from Morningstar as of year-end 2022—great recognition of strong performance.

Life insurance recognition: Last year, Thrivent was recognized by Forbes as America’s top term-life insurance company. This award, which was voted on by more than 15,000 independent participants, speaks to the strength of this product and its importance to our clients.5

A billion-dollar milestone in community impact: At Thrivent, we offer more than just financial services; we help our clients live generously. In 2022, we reached a major milestone of $1 billion in funds raised by clients and their communities through Thrivent Action Teams, a popular program that began in 2014.

Thank you for allowing us to serve you during the ups and downs of 2022, to help you prepare for the future and to make the most of all you’ve been given by God.

When we meet with our financial advisors and clients, we often hear stories of multigenerational families served by Thrivent: grandparents, parents, children, grandchildren and even great-grandchildren. Nothing makes us prouder than that. Because that shows the trust you put in Thrivent.

We don’t take this trust lightly. We’ll continue to work hard to earn it—with the focus on you.

We did a lot in 2022. Together.

Strong, stable and here for our clients

management/

advisement*

management/

advisement*

Recognized for excellence

of 13 rating categories²)

from A.M. Best

(June 2022)

the Fortune 500

(May 2022)

of 13 rating categories²)

from A.M. Best

(June 2022)

the Fortune 500

(May 2022)

Putting purpose to work

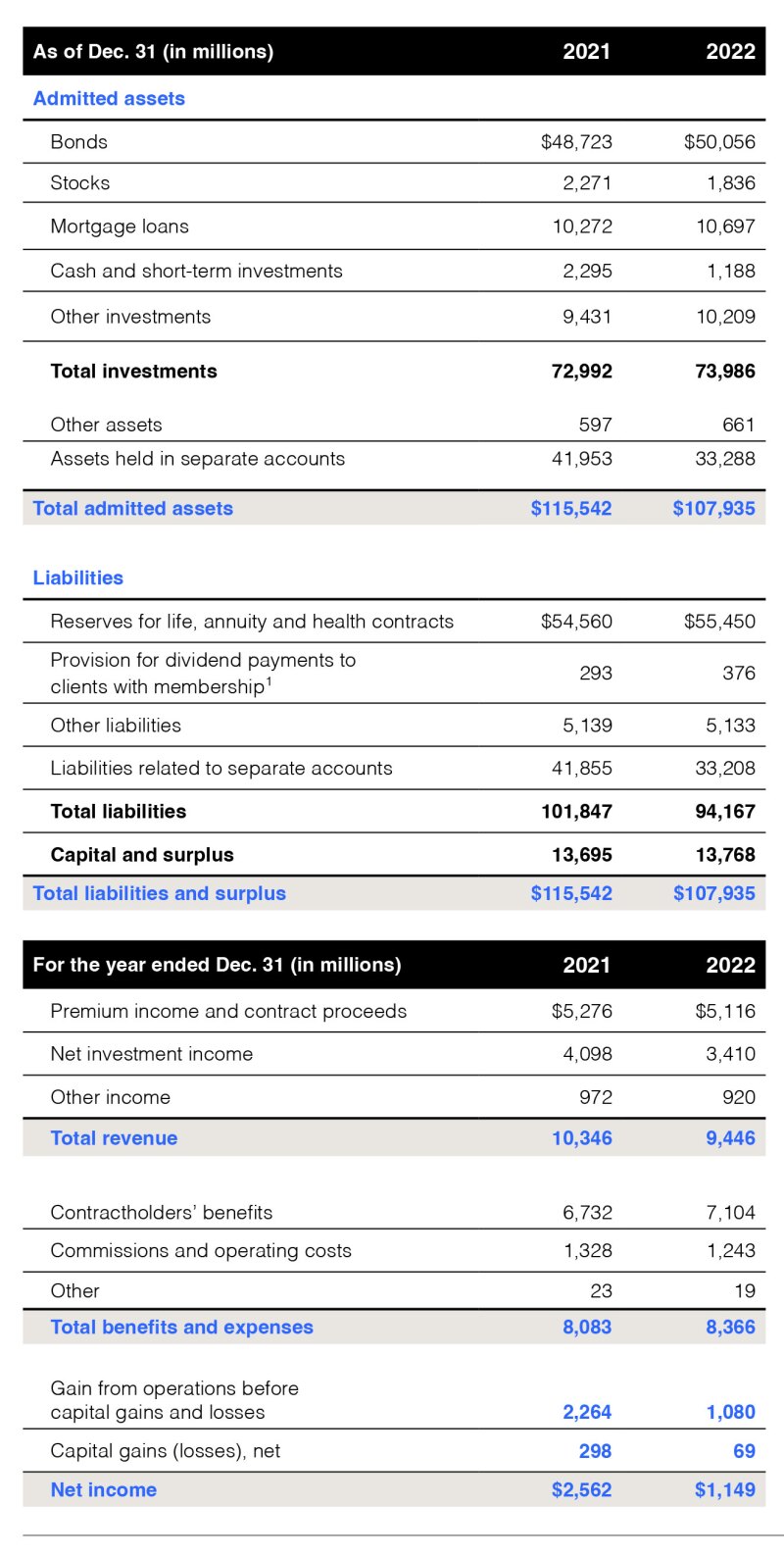

Thrivent 2022 financial results

Condensed statutory financial information

Advice & solutions for a range of needs

guidance

guidance

1Dividends are not guaranteed.

2Ratings based on Thrivent’s financial strength and claims-paying ability. Does not apply to investment product performance.

3“World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Ethisphere LLC. For details, visit Ethisphere.com.

4The Thrivent Mutual Funds call center is part of Thrivent Financial Investor Services, Inc., the transfer agent for Thrivent Mutual Funds. Thrivent Financial Investor Services is a subsidiary of Thrivent.

5The 2023 Forbes Top 10 Term Life Insurance Companies is a listing developed by Statista, a provider of market and consumer data. The 2023 list includes categories for providers of three Property & Casualty Insurance and two Life Insurance products. The winners were determined based on an independent survey from a sample of over 15,000 U.S. citizens that were insurance company customers across the nation. For each category, the insurance company with the highest score was awarded. Companies offering only health insurance or insurance products only via employers were not considered. Respondents rated the insurance companies on a variety of factors including general satisfaction, whether they would recommend, loyalty, financial advice, customer service, price-performance ratio, transparency, digital services and claims/damage/benefit. This rating may not be representative of any one client's experience although it does include the feedback from a sample of Thrivent's clients. This rating is not indicative of future performance. A licensing fee was exchanged in order to advertise this recognition.