Growing Thrivent to serve current and future generations of clients

Dear Thrivent clients:

We thank you for being part of Thrivent as we celebrate the impact we made together in 2023 and share how we’re growing Thrivent to serve future generations.

Thrivent clients are truly unique. You lead lives of service and faith, and you use your money as a tool to achieve these goals. You partner with our trusted financial advisors to plan for the future, establish legacies for your loved ones, and create stronger families, churches and communities.

Together, the difference we’re making is significant.

Driving impact

Thrivent has a long legacy of impacting communities and strengthening individuals, families and communities, with and through, our clients. Together in 2023, we achieved significant milestones, including:

- Leading 157,303 Thrivent Action Teams, a record high, to support causes clients care about most.

- Directing $31.4 million in Thrivent Choice Dollars® to charity—with more than half of funds going to churches.

- Volunteering 14 million hours—donating time and talent in communities throughout the U.S.

- Raising and donating $306 million in funds.

We also surpassed $1 billion in funds raised through our Thrivent Action Teams program. Since the program began in 2014, we’ve organized more than 1 million volunteer teams and contributed over 90 million hours of community service.

From everyone at Thrivent, thank you for using your God-given gifts to make a difference in your communities and showing the world why we’re unlike any other financial services organization.

Delivering value

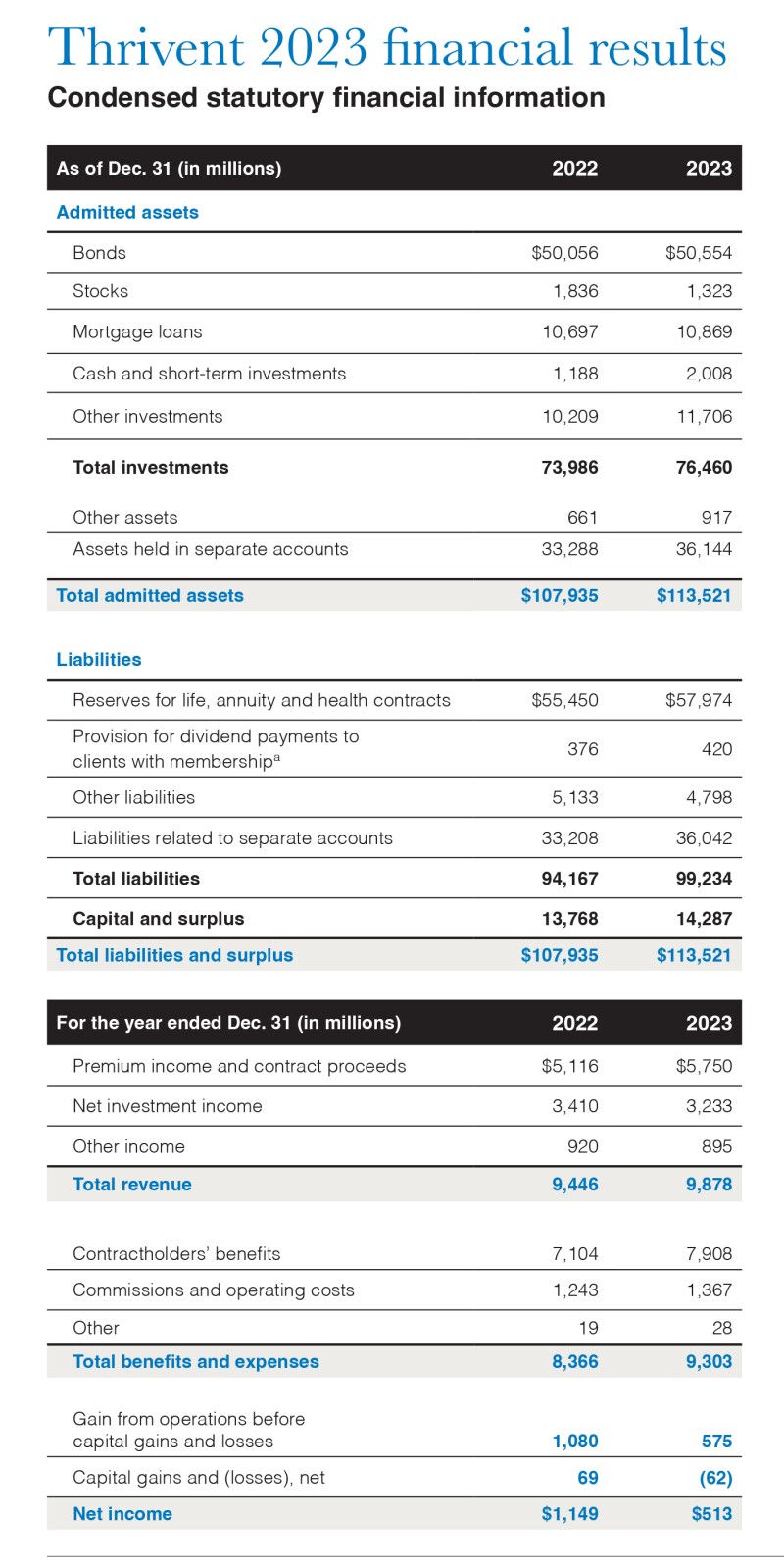

In 2023, we continued our disciplined approach to building and preserving Thrivent’s financial strength and stability. We grew our adjusted surplus to $17.3 billion by year-end, the strongest capital position in Thrivent’s history.

Our financial strength means that our members get to share in our success. In 2024, Thrivent will provide $542 million in dividend payments and policy enhancements, such as additional credited interest and reduced fees, to clients with membership. That’s a record-setting year that surpasses our 2023 payouts by 26%.

Growing sales

Growth ensures we can continue to drive impact, deliver value and meet more of your needs. We worked hard during the year to grow Thrivent—delivering 2023 enterprise revenue (the total income we receive from all sources, including sales) of $10.6 billion, which was a 6% increase from 2022.

Our financial strength allows us to:

- Continue our efforts to provide you with holistic, purpose-based advice that is personalized and actionable.

- Offer engaging educational and generosity programs that reached 2.5 million people.

- Develop product enhancements to meet your needs in a lower interest rate environment.

- Improve our digital experiences to make it easier to work with Thrivent.

Looking to the future, we’ll continue to drive growth and build on our progress to make your Thrivent experiences even more intuitive and seamless.

Serving future generations

There’s no organization like Thrivent, and the connections we share with you are a key part of why we’re so special. When we meet with our financial advisors and clients, we’re humbled by the stories that we hear of multiple generations being helped by Thrivent. It’s our goal to serve you today and extend Thrivent’s legacy to your children and grandchildren.

Thank you for all that you do and for trusting Thrivent to serve you. We look forward to a blessed 2024 and continuing our journey together, right by your side.

| Teresa J. Rasmussen President and CEO | N. Cornell Boggs Board Chair |

Celebrating 2023

Strong, stable and here for our clients

management/

advisement*

management/

advisement*

Recognized by others

of 13 rating categories²)

from A.M. Best

(June 2023)

of 13 rating categories²)

from A.M. Best

(June 2023)

Putting purpose into action

Advice & solutions

for a range of needs

1Dividends are not guaranteed and do not apply to all products or clients. Policy enhancements refer to improvements in non-guaranteed policy features such as future credited rates or fees. These enhancements are not guaranteed in the future.

2Ratings are based on Thrivent’s financial strength and claims-paying ability. Does not apply to investment product performance. For information on each rating, visit the individual rating agency’s website.

3“World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Ethisphere LLC. For details, visit worldsmostethicalcompanies.com.

4The Thrivent Mutual Funds call center is part of Thrivent Financial Investor Services, Inc., the transfer agent for Thrivent Mutual Funds. Thrivent Financial Investor Services is a subsidiary of Thrivent.

5For information on this rating, visit

Member benefits, programs and activities are not guaranteed contractual benefits. You should never purchase or retain any insurance or annuity products simply to be able to participate. Participation is subject to applicable Terms and Conditions.

The Thrivent Choice® charitable grant program engages Thrivent clients with Membership and Thrivent Member Networks in providing grants that support charitable activities, furthering Thrivent's mission and its purposes under state law. All grant decisions, including grant recipients and amounts, are made at the sole discretion of Thrivent. Directing Choice Dollars® is subject to the program's terms and conditions available at thrivent.com/thriventchoice.