Starting a new year brings with it a natural opportunity to revisit and refresh the priorities in your life. It's the perfect time to set meaningful new goals, whether that's adjusting your career path, spending more time with your family or volunteering more in your community.

Your finances are another area that can benefit from a yearly tune-up and adopting some new, positive money habits. It may seem like a lot of ground to cover, but even a few modest adjustments can put you on the right track for the year.

We'll cover six financial resolutions to consider to improve your money management skills in 2024:

1. Set financial goals & plan for them

Making changes starts with focusing on what's most important to you. Then establish how to get there. Ask yourself some questions to identify what you want to work on: What milestones will matter to you in 10 or 20 years?

Let your values guide you

Every dollar you allocate toward one purpose—whether it's utility bills or retirement savings—is a dollar that's not available for something else. Inevitably, you have to prioritize what matters most when choosing what to do with your money.

In Thrivent's Financial Crossroads Survey, participants often reported making financial decisions at the expense of their personal values. But that doesn't need to be the case. In fact,

Now that you're starting a new year, do some reflection on what values you hold dear. It could be family, financial security, work-life balance or service to the community. Be sure to create goals that reflect your core ideals.

Make your goals SMART

SMART stands for specific, measurable, achievable, relevant and timely.

For example, you may know you want to buy a house. Recognizing that goal is a good start, but it doesn't give you a structure to accomplish it. Using the SMART framework, "buying a house" can be fleshed out as a commitment to opening a high-yield savings account and adjusting your current budget so you can add at least $500 to it every month via automatic transfers until you have enough for a down payment.

Once you have your SMART goals, share them with others to keep you accountable. Discuss your financial resolutions with your family so they can encourage you along the way and share their own goals with you.

2. Be intentional with saving & spending

The start of a new year is a convenient time to assess how you allocate your money and whether you have a realistic balance with your saving and spending. A sound plan for reaching your goals will address your needs both for today and years down the road.

Make a savings plan

Setting aside money for future use may seem challenging if you have a tight budget. But saving even a small portion of your paycheck for long-term financial goals can give you a feeling of assurance that you're progressing steadily toward your goals.

Rather than merely saving any money you have left over after your monthly spending, consider the

Create a comprehensive budget

For your savings goals to be sustainable over time, you may need to adjust your existing spending. That means

Review your monthly costs, dividing your expenses into essential spending, such as housing and groceries, and discretionary spending, such as entertainment and dining out. As you assess where your money is going every month, you can identify potential ways to save—whether that's by canceling unused subscriptions or buying fewer new clothes. Prioritize your spending. If you had less income and had to decide what to cut, what would you do? That question can help clarify what really matters to you.

Free money coaching

3. Manage debt strategically

Regularly carrying

Reduce high-interest debt

You can

Build an emergency fund to stay out of debt

Experts suggest having

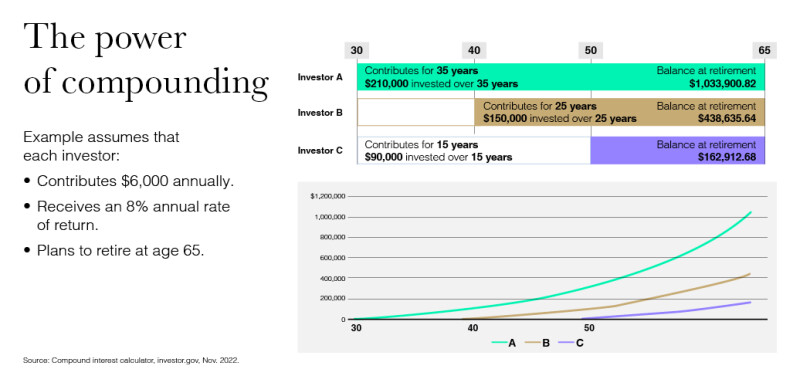

4. Prioritize saving for retirement

The

Renewing your focus on your retirement strategy with that in mind is one of the best gifts you can give your future self.

Review your contribution levels

As you set financial goals for the new year, you may want to review and adjust the amount you're putting into your nest egg. If you have a 401(k)-style retirement plan at work, it's a solid primary step in building your retirement assets—especially if your employer offers

- For 2024, you can contribute up to $23,000 ($30,500 if you're 50 or older) to your 401(k), 403(b) or 457(b).

- Another option you can pursue for retirement saving is a

traditional or Roth IRA . For 2024, you can put up to $7,000 into these accounts if you're younger than 50 and up to $8,000 if you're 50 or older.

A common guideline is to set aside 15% of your paycheck, although your target contribution level should reflect your retirement date and when you started saving. If 15% isn’t realistic at this point, that’s OK. Just save as much as you’re able.

Review your investment allocation

Changes in asset values throughout the year can cause you to end up with a portfolio that no longer reflects your investment objectives and risk tolerance. For example, a stellar year for the stock market might create an asset mix that's more stock-heavy than you desire and vice versa. Review your retirement accounts at the start of the year to make sure you're not taking on undue risk. If necessary,

5. Protect the people you love

Safeguarding your family against life's "what ifs" is one of the most loving acts you can do for them. That includes having the right amount of

Also, review your

6. Plan to be tax-efficient

The kinds of investments and accounts you have and how you use them have tax implications both year to year and across your lifetime. As the new year gets underway, make sure you have a

Stay informed about changes in tax laws

The IRS typically makes inflation adjustments each year, both when setting up tax brackets and deciding how much you can contribute to tax-advantaged accounts, such as for retirement and health savings. Factoring these updated limits into your financial strategy may allow you to generate additional tax savings in the new year.

Also, review any financial laws that will take effect or sunset in the next year or two to decide if these changes could impact your financial strategy. For example, several important provisions in the

Leverage tax-efficient investment strategies

Workplace retirement plan contributions lower your taxable income. And if you contribute to a

A quick start-of-the-year checkup can ensure you're investing efficiently. If you have investments outside of a retirement plan, you may want to consider tax-efficient mutual funds and other assets that reduce your taxable gains.

Continuous financial self-improvement

In addition to making necessary adjustments to your financial strategy now, commit to developing healthier habits throughout the year. For example, you may want to:

- Seek out ongoing financial education to make informed decisions

- Enhance your financial literacy by attending workshops or reading money management books

- Regularly track and assess progress toward financial goals, adjusting your strategy as needed

Creating financial goals can help you identify what you truly value in life and feel more confident about your finances. But you don't have to go it alone. A