Is life getting in the way of your savings goals? It can be hard to tuck money away when you have bills to pay and essentials to buy. By the time you've taken care of your monthly needs (and maybe a few wants), your bank account might be just about empty.

If this sounds familiar, you might benefit from the "pay yourself first" approach to budgeting. This strategy puts saving for the future at the top of your financial to-do list—before your hard-earned money goes anywhere else.

What is the 'pay yourself first' budget?

The "pay yourself first" budgeting method has you put a portion of your paycheck into your retirement, emergency or other goal-based savings account before you spend any of it. When you add to your savings immediately after you get paid, your monthly spending naturally adjusts to what's left.

How does the 80/20 rule factor into paying yourself first?

The 80/20 rule is a simple guideline that you can follow to pay yourself first. It means putting 20% of your income toward savings and 80% toward everything else. Paying yourself first can be effective because it ensures you save something every pay period, and it reduces the chance that you'll spend money you intended to save.

What are examples of paying yourself?

Paying yourself first—sometimes called reverse budgeting—may seem like a fresh approach to your budget. But you may have already encountered it without knowing its name. Paying yourself first can describe any scenario in which you prioritize saving for the future over current spending. Here are a few common examples:

- You contribute part of your paycheck to an employer-sponsored retirement savings plan, such as a

401(k) .

- You set up a split direct deposit so a portion of each paycheck goes to a savings account while the rest goes to checking.

- You pay monthly premiums to a permanent life insurance contract that accumulates

cash value .

How do you pay yourself first?

Paying yourself first involves a few easy steps:

1. Decide what percentage of your income to save.

While the 80/20 budget works for some, you can choose any percentage you want.

If your fixed expenses are high, you might save 10% of your income. If they're low, you might save 30%. Pick an amount that somewhat challenges you but that's realistic to set aside each month.

To find the sweet spot, you'll need to find a

- Determine your monthly income before taxes. Let's say it's $9,000.

- Review your essential expenses—including taxes, housing, utilities, loan payments, transportation costs, child care, food, medical expenses and other bills. Use a budgeting app, such as

Must qualify for membership in TCU.

Any data or personal information collected by websites other than Thrivent is not covered by Thrivent's privacy policy. We recommend you read the privacy policies of those sites as they may be different from Thrivent's policy. - Review your nonessential expenses, such as going out for dinner and seeing movies. Let's say your total is $700.

- Total up your expenses ($7,200) and subtract them from your income ($9,000). Then divide the result ($1,800) by your income to get the percentage available to save (20%).

Make sure you're happy with the amounts you're saving and spending, and ask yourself whether there are opportunities to spend less. When you find ways to cut expenses, you can use the money you're freeing up to boost your savings.

Pay yourself first

2. Decide where to direct your savings.

If you're saving 20% of your income, you might want to put 10% into a retirement account, 5% into emergency savings and 5% into travel savings. Do what supports your goals.

Choose or create

3. Set up automatic transfers.

Once you've arrived at a number you're comfortable with, you can set up automatic payments to ensure you always get paid first. This money shouldn't stay in the account you use day to day because it would be easy to accidentally spend or overlook it.

For instance, if you get paid electronically, you might allocate10% of your pay into your workplace retirement plan, send 10% to your savings account and send the remaining 80% to your checking account.

If you're paid irregularly or by check, you can set up a recurring transfer. This allows you to move money from your checking account to a designated savings account at a certain time every month. You can automate transfers to investment accounts, too.

Is paying yourself first right for you?

Putting a "pay yourself first" strategy into action is pretty straightforward. But before jumping in, consider whether paying yourself first will work for you and how it might affect your other financial goals.

Limited budget constraints

If 100% of your earnings go to necessary bills, then you're living paycheck to paycheck, and paying yourself first may not be possible at the moment. In that case, you're better off focusing on strategies to grow your income, make your lifestyle more affordable or decrease your debt.

Stuck on spending

Paying yourself first may not be helpful if you're spending without limits or taking on credit card debt. You might benefit from controlling your discretionary spending before setting out on this strategy as the interest rate you'll pay for debt will almost always be higher than the interest rate you'll earn on savings.

If you aren't living beyond your means and you just haven't prioritized saving, paying yourself first could be a worthwhile endeavor.

Balancing debt payoff

The

- You may want to go ahead with paying yourself first and stick with minimum monthly payments on debts for now if you haven't established an

emergency fund yet. Once you've built up some emergency savings, you could pause paying yourself first and instead direct that money towardreducing your debt .

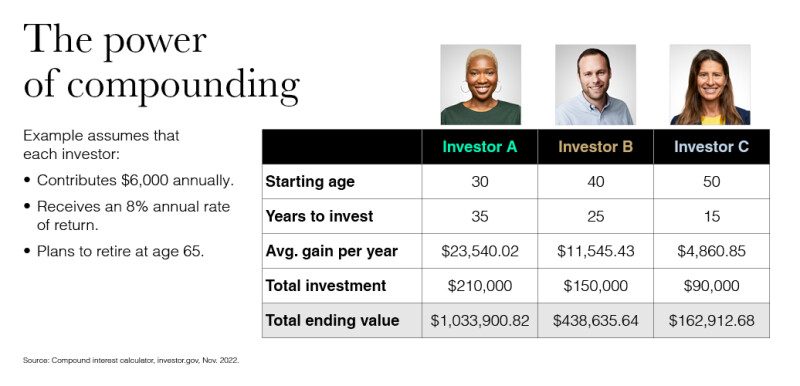

- If you haven't started

saving for retirement yet, that could be a reason to prioritize paying yourself first alongside a debt reduction plan. Retirement accounts often come with tax advantages, anemployer match and opportunities to experience compound growth over time, especially if you start saving as early as possible.

- Compare the interest rates you're paying on your debts with the rate of return you get on your savings or investments. If you're dealing with high-interest debt, paying it down might be the more urgent priority. But you might want to go forward with paying yourself first if you have a low-interest student loan, car loan or mortgage.

It doesn't have to be an either/or decision. If you calculate that you can cut 30% of your discretionary spending, you might choose to pay yourself first with a portion of it while using the rest to pay down high-interest debt. Once your debts are paid off, or perhaps refinanced at a lower rate, you can put more money toward savings.