Josh and Ellen Nolan knew they needed to get their financial house in order, for themselves and their children. For the Thrivent clients from Medina, Ohio, however, it wasn’t just about taking care of their finances and getting guidance for their goals. They also wanted to find ways to connect with their community. And they wanted to be able to pass all of that—the financial and the nonfinancial—on to their two children, ages 15 and 12.

“We came to Thrivent with a pile of papers, a list of goals with different investing strategies and levels of comfort, and two kids that we want to educate,” says Ellen. “‘How do we do this,’ was our question.”

The answer started with a series of questions that helped their financial advisor, Hannah Magrum of Medina, Ohio, get to know them. They each individually talked about goals, how they view money, their

“It was really helpful to have someone ask about us first, about our needs in the moment, about the things we’ve thought about for our future,” says Josh.

Those questions helped the Nolans get on the same page with their goals and gain a better understanding of their different communication needs.

“We were able to get a sense of who we are personally,” says Ellen, “to figure out a good approach that makes each of us feel good about how we’re tackling our goals.”

Knowing that money is a tool, not a goal, says Magrum, it’s important to develop deeper conversations with clients about who they are, what they value and what’s important to them.

“It’s more than just investing and growing your money,” Magrum says. “I believe strongly in education and helping clients make informed and empowered decisions. It’s about discovering the purpose of your money; then we can come up with the different solutions to address your needs.”

Wherever you are on your financial journey, it’s never too soon, or too late, to get advice.

2023 at a glance

Getting to know you

Whether you’re getting acquainted with a new-to-you financial advisor, or you’ve been with your financial advisor for years, he or she will want to know about your family, your occupation, what you like to do for recreation and how you have managed your finances. This is all information that can change as you go through life. He or she will also ask about your personal and financial goals—short-, mid- and long-term—to help gauge where you’ve been, where you are and where you want to be. These questions can help the financial advisor provide you the best

There also may be questions like:

- What are you most afraid of? These are the things about your finances that keep you awake at night, says Magrum, and elevate to the top of the list of priorities in developing your financial plan.

- What does your best life look like? “One day when we have to look in the rearview mirror, we’ll have to ask ourselves what was important about being here,” says Jon Skov, Thrivent wealth advisor in Dartmouth, Massachusetts. “It’s not just about retirement; it’s about relationships, opportunities and legacy. Can we identify what matters and align our financial resources to make it happen?

- What does your financial house look like? What level are you on? Since your financial advisor will be helping to create a blueprint to guide you on your financial journey, he or she has to know where you’re starting and where you’re headed. “It’s not about pushing a product; it’s about understanding your goals and where you are on the way to reaching them,” Skov says. “Many people will settle for Plan B. First I’d like to know what Plan A looks like. Let’s try to do that.” Together, you’ll identify any gaps and discern the next steps.

Evaluating readiness

The

Some

- How much support do you prefer to help you understand your current financial picture? This is all about setting expectations, Anderson says. “How frequently do we need to get together and how much do you want to be part of the process? That differs for everyone, and it’s important to know where you are.”

- What do you value most about working with a financial advisor? In the past you may have had some great experiences with a financial advisor, but you also may have had some that were less than positive. By sharing what you value, Anderson says, this brings your expectations today to the forefront.

- Are you ready for advice? Many times, people seek advice to remedy a financial pain point, says Skov. However, it’s important to have an open mind in receiving advice. Time is invested as you explore, discern, document and create a financial blueprint. You’ll both want to use that time wisely.

Taking the next step

For many, taking the first step to open the conversation with a financial advisor is the most difficult.

“Life gets busy and thinking about this stuff isn’t always exciting,” Magrum says. “But if we can take that first small step and then another, the impact can be big.”

For the Nolans, working through some challenging financial topics and perspectives and learning more about Thrivent’s membership programs opened a whole new door for them. It enabled them to follow their dream of starting a nonprofit—Spark Medina—that engages youth, families and nonprofit partners in meaningful service-learning opportunities in their community of Medina, Ohio. Thrivent Action Teams and Thrivent Choice® have given them space for larger giving than they ever anticipated.

“Josh and I felt like once we had our financial house in order, it allowed us to look at the passions we both have to truly create impact within our own community, amongst neighbors,” Ellen says. “It gave us a launching pad of confidence to take a leap on something we both really believed in.”

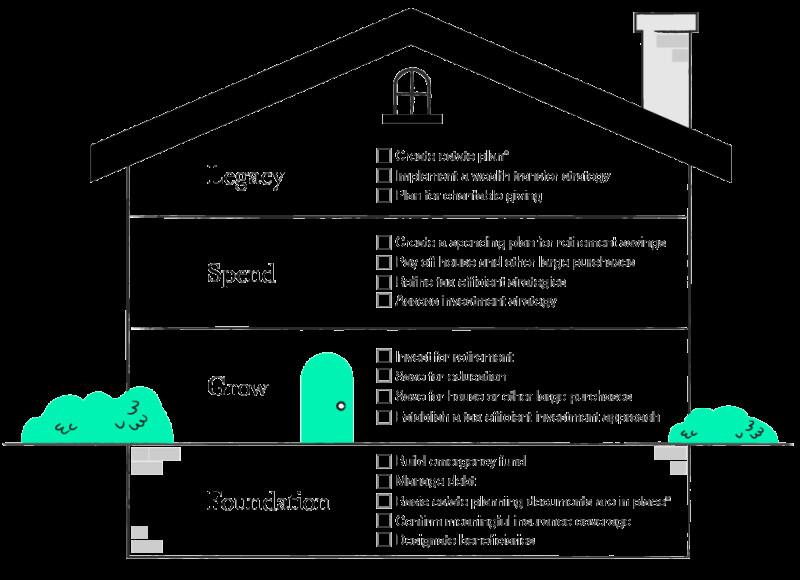

A blueprint for your financial plan

When you’re building a new home, your construction crew will follow a blueprint to help ensure the final product is well-built, beautiful and meets your wants and needs. Similarly, your financial plan needs a blueprint, so it can be built to withstand the ups and downs of life.

At Thrivent, we use a

Foundation: A home needs a solid foundation to withstand the test of time. And so does your financial plan. This framework includes understanding your financial position and

Grow:

Spend: There’s a time to save and a time to spend. In this level of your financial house, you look at turning the goals and dreams you’ve been saving for into reality. You can discover tax-efficient strategies to help you manage your tax burden.

Legacy: Everyone has assets like money, property and belongings. Conversations and activities at this level help prepare you and your family for how and when you wish to transfer assets to the people or causes important to you.

How Thrivent can help

Thrivent financial advisors have a variety of tools that can help you understand your current financial situation. They’ll identify strategies and solutions as you create the framework for your personalized financial house together.