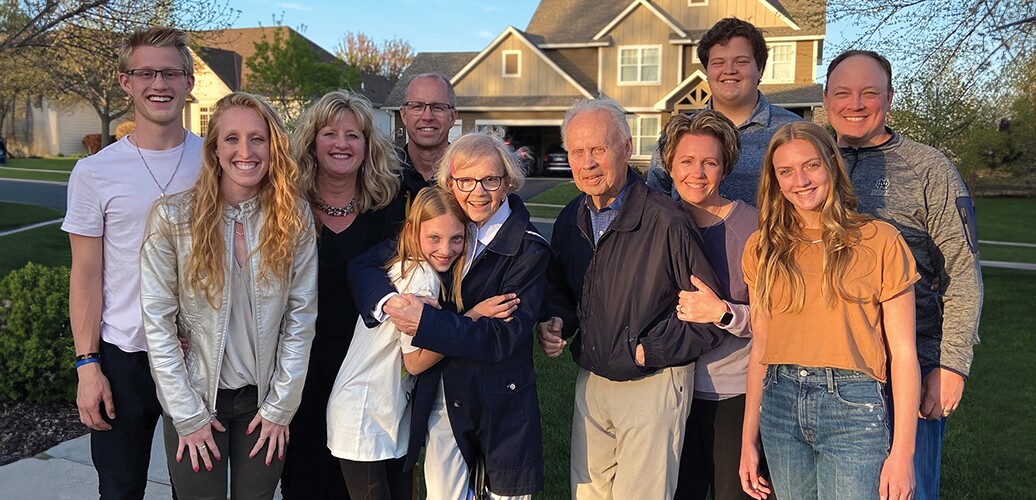

Two decades ago, Thrivent clients Les and Darlene Swenson sat down with their son and daughter, Greg and Cindy, to detail their plans to set up a family fund. The couple from Maple Grove, Minnesota, made it clear that this was a seed that would continue to be nurtured and grow over time to help support causes that were important to their family and community.

The Les and Darlene Swenson Family Fund was established in 2003 through

Cindy appreciates that her parents took the time to hold family conversations about philanthropic goals.

“They engaged us by sharing stories of their giving and why it was important to them,” she says. “They were proud to help us appreciate the importance of using our resources to be able to give back—and that there is some responsibility to honor this.”

Les passed away last December at the age of 84. Darlene now lives in Plymouth, Minnesota, and continues to be involved in the family fund. As Les’ health declined, Greg and Cindy worked very closely with their parents to make sure they understood and supported their wishes for the family fund.

“Through those conversations, we were lucky enough to understand truly how proud Dad was to have set this up and to know that he'd like us and our kids to carry it forward,” Greg says. “We also look forward to the day where we can involve our own children even more in that giving.”

It all starts with communication

It’s important for parents to have intentional conversations around generosity, says Kelly Jones Williams, a financial advisor with Thrivent’s Your Journey Financial Advisors in Hickory, North Carolina.

“Preparing the next steward of your assets is not a task to take lightly,” Jones Williams says. “It’s easy to encourage stewardship through example of how we use our time or talents, but we aren’t as open about how we use our treasures. The greatest way to learn is by example. This holds true to how we use our money as well.”

One of her favorite tools for clients is leveraging a

“Parents are excited to give their children and grandchildren the opportunity to continue giving to causes that are important to them, but also continue to teach them how to be great stewards of money,” Jones Williams says.

Empowered to serve through Thrivent Action Teams

Thrivent members can access other tools to help teach their family about philanthropy, too. Emily and Greg Herman of Shoreview, Minnesota, have helped lead

“I grew up with parents and grandparents who were always very generous, so I had it modeled to me from a young age what it looks like to be generous with your time and your resources,” says Emily, a third-generation Thrivent client. “From the time I first became a parent, I knew this was something I wanted to also instill in my kids.”

As the school’s admissions and development coordinator, Emily has been spreading the word about Thrivent Action Teams to other Thrivent members with children at the school.

Last year, several of these families came together to organize a service project focused on campus beautification. “[The] goal was to improve the exterior of the school by adding plants, shrubs, trees and doing weeding,” Emily says. She and her husband participated by providing a Community Impact Card from Thrivent for purchasing plants and supplies, and she also assisted with day-of volunteer organization. In total, approximately 330 students participated (including the Herman’s children), along with 40 staff members and 20 additional volunteers.

Thrivent Action Team kits include a Community Impact Card with up to $250 in seed money that can be used to bring a project to life, “Live Generously” T-shirts, thank-you cards, name tags and stickers.

The kit also provides information on how to leverage Thrivent Action Team’s digital tools, which include a personalized project web page to share with the member’s community, an RSVP feature to invite friends and family to collect RSVPs online, and a photo upload tool.

Emily is once again coordinating Thrivent members for the school’s 2024 service project, which involves packing meals and backpacks with school supplies for families nearby that need additional resources. For another service project, the Herman children used the Community Impact Card from Thrivent to help gather more books for the classroom, so young students could enhance their reading skills.

“When I became aware of Thrivent Action Teams, I was thrilled to know that it was something available as a resource, and that my husband and I could pick organizations or causes that matter to us,” Emily says.

Thrivent's generosity resources

Thrivent's generosity resources

Thrivent clients with membership can

For example, Canfield’s children wanted to conduct a fundraiser for their church’s youth program by hosting an outdoor movie at their home with a small entrance fee.

Canfield applied for a Thrivent Action Team and her children used the seed money to print flyers to spread the word. They also purchased concessions to sell at the event, and the $500 in total proceeds they yielded from the event was donated to the church’s youth program.

“It was a great way to teach the kids about giving back,” she says. “The tools that I have through Thrivent to teach my kids about generosity and giving back have been priceless.”

Canfield’s team at Thrivent works closely with financial advisors to help promote Thrivent member benefits, including programs like the Thrivent Action Teams that focus on giving back via volunteering.

“Thrivent loves to support our clients on ways to give back, and we can do that through many different ways,” she says.

To truly foster a love for volunteerism in children, parents should let them drive initiatives, Jones Williams says. Don’t just have them tag along on the causes that matter to the parents. Rather, allow them to choose causes that matter to them and then come alongside them to serve.

“In my experience, I have seen no greater way to receive gratification than giving,” Jones Williams says. “In an increasingly tough financial world, making this a priority for your family will be more important than ever. It also creates a value system that holds families together long after parents are gone.”

Katie Kuehner-Hebert is a freelance writer in California.

How does a donor-advised fund work?

Through making a charitable gift to a donor-advised fund you will potentially receive tax benefits, and those assets can grow over time through investments in diversified portfolios. It's all for the purpose of maximizing flexibility and impact of donations to charities, including churches, schools and other nonprofits, says Greg Shamey, vice president of Charitable Giving Services at

Shamey says that funding for donor-advised funds can come from a wide variety of asset types such as cash, stock, mutual funds, real estate, businesses and cryptocurrency. Thrivent Charitable then converts funding sources into cash to be invested in the donor-advised fund.

In May 2024, a new suite of investment offerings was launched to give donors more options on the time horizon for when they wish to distribute those charitable funds.

“For example, someone who may want to distribute their funds over a 10-year period may choose a different investment strategy than a donor who has a three-year time horizon,” Shamey says. “We now have a wider array of investment offerings that ultimately align with someone's charitable goals and risk tolerance.”

Money contributed to the fund is potentially eligible for a tax deduction for that year, and any gains within the charitable fund are tax-free. Donors can distribute dollars to charitable causes and organizations in as little as $100 increments, and they can do so at the time of their choosing.

“Our approach is to bring intentionality to generosity and supporting causes that are near and dear to people’s hearts,” Shamey says. “It’s important to name those within their overall financial plan, but a lot of individuals don't know where to start or how to articulate their philanthropy goals to their family and friends.”

Thrivent Charitable provides a

“If you're intentional about communicating your philanthropy goals during your lifetime, it really brings everyone together,” Shamey says.