Uncertainty always has been part of investing, but today’s market feels especially unpredictable. As questions about a potential recession continue to surface, many investors are wondering how to keep their retirement plans steady in the face of a down market. While no one can predict exactly what’s ahead, there are steps you can take now to stay focused, protect your savings and make informed decisions about your future. Here's how to prepare and reasons why staying the course might be your strongest strategy.

Will there be a recession?

As 2025 unfolds, market watchers and investors alike are grappling with mixed signals. Short-term data points to a weakening economy, while longer-term outlooks still suggest slow but steady growth. So, what does that mean for your portfolio?

Some wonder if the turbulence is just a temporary dip in an extended

“The best way to prepare for market volatility is not to be surprised by it,” says David Royal, executive vice president and chief financial & investment officer at Thrivent. “Have a conversation with your financial advisor and be sure you understand how your current financial strategy is positioned to meet your long-term goals. Remember, too, that times of volatility can be potential opportunities, depending on your financial goals.”

Let’s unpack what economic volatility could mean for the road ahead, and how you can confidently stay invested.

The best way to prepare for market volatility is not to be surprised by it.

Keep perspective: The market has a strong track record of recovery.

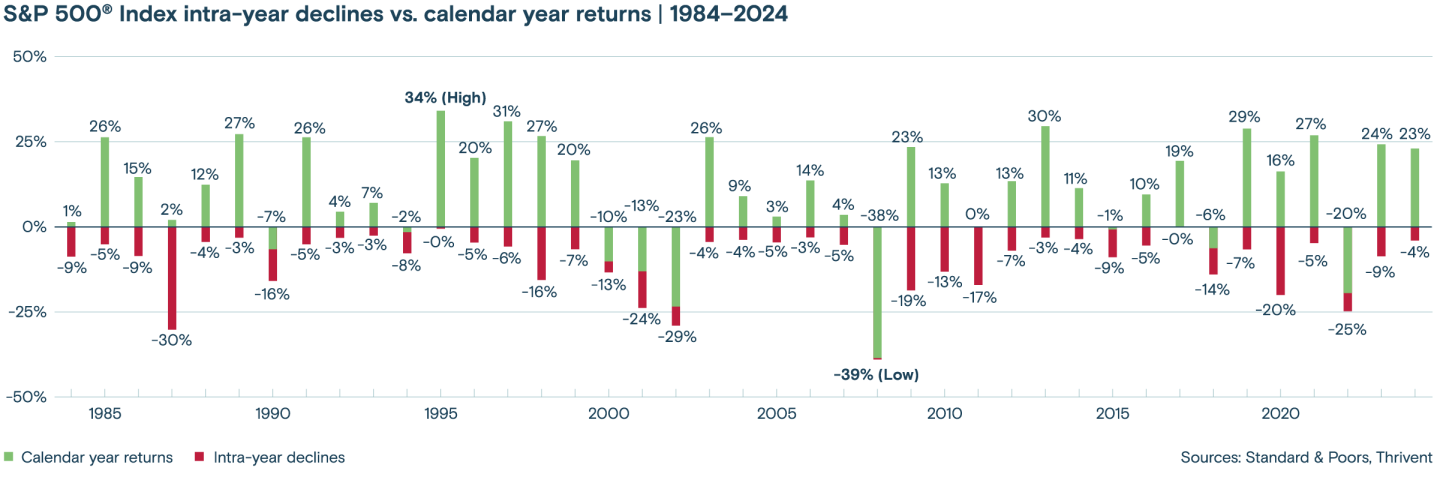

Over the past 41 years, the stock market has finished in positive territory more than 75% of the time—even in years marked by steep intra-year declines. The chart below* highlights this by showing the annual performance of the S&P 500® Index (in green) alongside the biggest drop within each year (in red).

It’s a helpful reminder that short-term downturns, while unsettling, are part of a long-term investing journey. Even seasoned investors feel the pull of uncertainty during volatile stretches—but those periods eventually pass.

As you continue building and adjusting your portfolio, focus on what you can control: maintaining balance, staying diversified and keeping your long-term goals in sight.

What can you do to help protect your retirement savings during market downturns?

To help ensure your savings are there when you need them, you can create or modify your financial strategy to prioritize diversification and financial products that support your goals. Stocks, bonds, real estate, annuities, cash and other assets may be combined to provide a reliable stream of income. A mix of liquid and illiquid assets can help you weather the expected ups and downs of markets. Consider

If you have short-term income needs in a volatile market, predictable and reliable retirement income solutions such as cash, annuities, certificates of deposit, some bonds, and Treasury inflation-protected securities may be worth considering.

Where is the safest place to put your retirement money during market volatility?

There’s no one-size-fits-all answer, but the safest options are typically cash equivalents (like money market funds or CDs), high-quality bonds, and certain types of annuities that offer principal protection. These options tend to provide more stability when markets fluctuate—though they may come with trade-offs like lower returns or reduced liquidity.

To understand how to balance safety and growth, it’s helpful to know the three broad investment categories:

Stocks offer the highest potential for long-term growth, but they’re also the most volatile and can experience sharp losses.Bonds are generally more stable and offer regular income, acting as a buffer during downturns—though they still carry risks tied to interest rates and economic conditions.Cash is the most conservative option and provides stability, but it may lose value over time due to inflation.

Building a diversified portfolio—with a thoughtful mix of these asset types—can help manage risk and weather volatility. You also might consider investments like annuities, certificates of deposit or Treasury inflation-protected securities (TIPS) to help safeguard part of your retirement income.

While no investment is entirely risk-free, a diversified, well-balanced portfolio tailored to your risk tolerance and time horizon is one of the best ways to stay protected when markets are uncertain.

Why is diversification important?

It is common wisdom among investors that

Diversification does not ensure a profit or protect against loss in a declining market. However, it is a great way to help build multiple income streams for living in retirement. It increases the likelihood that one or more of your income streams will be there to support you when you need it. Remember that diversification can help reduce market risk but does not eliminate it.

Should you pull your money out of the market and reinvest when things improve?

When the market dips, the instinct to pull your money out can be strong. After all, who wouldn’t want to avoid losses during a market correction? But

Market returns over a long period of time can be driven by a handful of strong performing days. Staying invested and avoiding the temptation to time the market can provide the best chance to catch those strong performing days, which often come on the heels of a downturn.

Even seasoned investors rarely get the timing exactly right. That’s why many experts recommend avoiding making emotional decisions and to stay invested and focused on your long-term goals rather than reacting to short-term swings.

Should you keep putting money in your IRA or 401(k) during market downturns?

In most cases, yes, you should continue to fund your IRA or 401(k), especially if retirement is still years away. These retirement accounts are designed for long-term growth, and continuing contributions during a downturn can allow you to buy investments at lower prices. Over time, staying invested through ups and downs has historically helped outpace inflation and build retirement income.

If you’re getting close to retirement or already retired, it’s a good time to evaluate your portfolio with a financial advisor and consider rebalancing. Make sure your investments are aligned with your short- and long-term income needs.

Also, don’t overlook

Before making changes, it’s wise to talk with a financial advisor who can help tailor your strategy to your timeline and goals.

Are annuities safe in a volatile market?

The security of an annuity depends on the type of annuity you have. Every type of annuity carries its own unique risks and rewards. For example,

In contrast,

Annuities may have other costs associated with them as well. These costs can vary. Some annuities have surrender charges only, while others have administrative fees, mortality and expense risk charges, and optional rider fees. The money contributed to an annuity typically can't be removed without a penalty charge.

Which stocks are safe in a down market?

There is no such thing as a safe stock. Investing, by definition, involves risk. Stocks offer the potential for growth, but they also are relatively risky and may experience significant losses. Consider a diversified strategy that incorporates a mix of long-term assets, guaranteed income sources and near-term (liquid) sources if you are looking to create a portfolio that can withstand changing market conditions.

How dividend stocks fare in a volatile market

If you are looking for a type of stock that tends to be less volatile than its aggressive growth counterparts, you may want to consider

Fixed income investments and market volatility

Equities come in many shapes and sizes—with varying degrees of risk. In the face of recession-related concerns, many investors choose to consider

Connect with a financial advisor on a plan for market volatility

With help, you can prepare your retirement for any market condition—good or bad—with a few considerations and reminders.

- Remember that fluctuations in the market—including cycles of prolonged bull and bear markets—are normal and expected. It’s important to prepare for both.

- Help build resiliency into your retirement strategy by distributing funds across four places: guaranteed income, short-term, medium-term and long-term funds.

- Establish a regular schedule to balance retirement savings and help stay on track for a comfortable retirement.

- Work one-on-one with

a financial advisor to gain a professional perspective or second opinion before making significant changes.