As you work diligently to build a strong financial plan for you and your family, it can be discouraging to think of a market downturn, or even a recession, sidelining your progress. Prolonged economic downturns are an inevitable part of the economic cycle. And while recessions are rare and typically only last around

Is a recession coming?

So far, 2025 has seen a fair amount of

“The best way to prepare for market volatility is not to be surprised by it,” says David Royal, executive vice president and chief financial & investment officer at Thrivent. “Have a conversation with your financial advisor and be sure you understand how your current financial strategy is positioned to meet your long-term goals. Remember, too, that times of volatility can be potential opportunities, depending on your financial goals.”

The economic cycle and investment opportunities

It’s true: Each stage of the economic cycle comes with investment opportunities in addition to risks. As the market revolves, you can make thoughtful choices about how to invest, even during a recession. The chart below shows the economic cycle rotating counterclockwise as driven by growth and inflation on the X and Y axes. Each stage lists strategic opportunities to consider for that period.

The Economic Cycle

Some investments tend to perform more reliably than others in turbulent times, such as large cap stocks or bonds. As always,

The importance of diversification

Many investors find it beneficial to invest in a diversified fund that includes a variety of

A

Don't forget dollar-cost averaging

In addition to diversification, many investors combat market volatility through dollar-cost averaging. This strategy tries to smooth out price volatility by investing a fixed amount of money into an asset at regular intervals, regardless of price. Over time, dollar-cost averaging can help reduce the overall cost of an investment—which is always a perk, but especially during a recession.

Six common market downturn investments

Choosing what to invest in during a market downturn depends on a few factors, such as your financial goals, time horizon and

While it's important to not derail your longer-term investing goals by making large changes to your investment mix, you may consider how these various investment types can help meet your financial goals:

1. Stocks

One approach is to reconsider how your stocks are distributed across market cap segments. Investors use

2. Bonds

Bond prices generally move in the opposite direction of interest rates. This is why they often rise during a recession, when the Federal Reserve may lower interest rates to stimulate the economy. However, lower-quality, high-yield bonds issued by less stable companies may not perform as well as higher-quality, investment-grade bonds in a recessionary environment.

3. ETFs and mutual funds

Similarly, a

Investment funds like these can give you exposure to a broad segment of the market, providing some of the benefits of diversification, such as reducing risk and balancing volatility.

4. Real estate & REITs

5. Commodities

When considering how to invest during a recession, some raw materials, such as

6. Cash and cash-equivalents

Economic downturns may tempt you to hoard your money, which is fair if you want

High-yield savings accounts can help you safeguard your cash during a recession, offering above-average rates of return in addition to easy access.- A

certificate of deposit (CD) is a fixed-term deposit account offered by banks and credit unions that pays a guaranteed interest rate in exchange for locking in funds for a set period. CDs can be a beneficial recession investment because they offer predictable returns and are FDIC-insured. Money market funds are a type of mutual fund that invest in short-term, liquid assets like cash and short-term securities. They offer a low-risk way to earn a modest return while maintaining liquidity.

Investing with historical market performance in mind

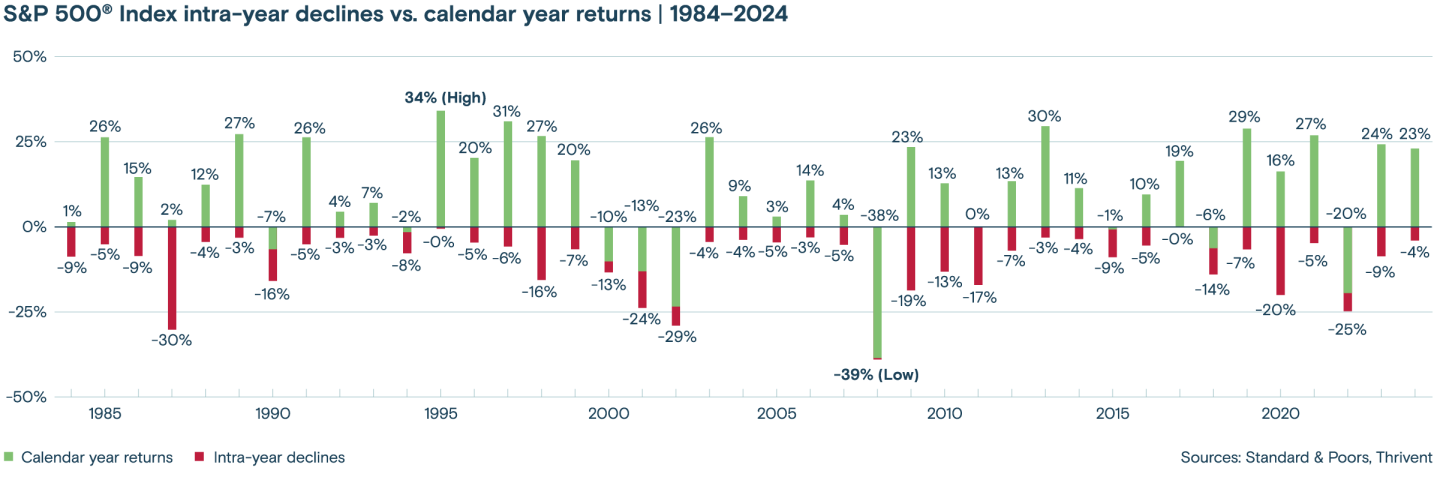

Finally, consider that over the last 41 years, the stock market has ended in positive territory more than 75% of the time. The following chart* shows the calendar year performance of the S&P 500® Index in green and the largest period of downward performance within each calendar year in red.

Economic downturns can rattle even seasoned investors, but they always pass. Keep the bigger picture in mind as you take steps to build, balance and diversify your portfolio.

The economy has shown remarkable resilience, but risks remain on both sides of the Federal Reserve’s dual mandate of full employment and stable prices. Economic data continues to send mixed signals, with areas of both strength and weakness.