Read on to learn how to invest in mutual funds, from defining your financial goals to monitoring your progress and making informed investment decisions.

What are mutual funds?

A

Returns from mutual funds come from two main sources:

How to invest in mutual funds

The process of mutual fund investing begins with some simple but crucial financial planning steps, followed by opening a brokerage account and monitoring and managing your funds. Here's a breakdown of how to invest in mutual funds, organized into five key steps:

1. Define your investing goals

Start by understanding why you're investing. Are you saving for retirement, growing your emergency fund or trying to build wealth? Mutual funds have different focuses; some may be best for long-term growth, while others emphasize income or stability, so defining your goals will help you choose the right ones for you.

Your time horizon—how long you plan to keep your money invested—also will influence the types of mutual funds that fit your needs. Longer-term goals typically allow for more risk, while short-term goals may require more conservative choices.

2. Define your risk tolerance

Knowing your

3. Determine your budget

Figure out how much you're willing to invest and how often. Many mutual funds have minimum initial investment amounts, which can range from $50 per month via a systematic investment plan to $3,000 or more as a minimum initial investment. Decide if you want to invest a lump sum or set up recurring contributions.

Consistent investing through methods like

4. Open a brokerage account

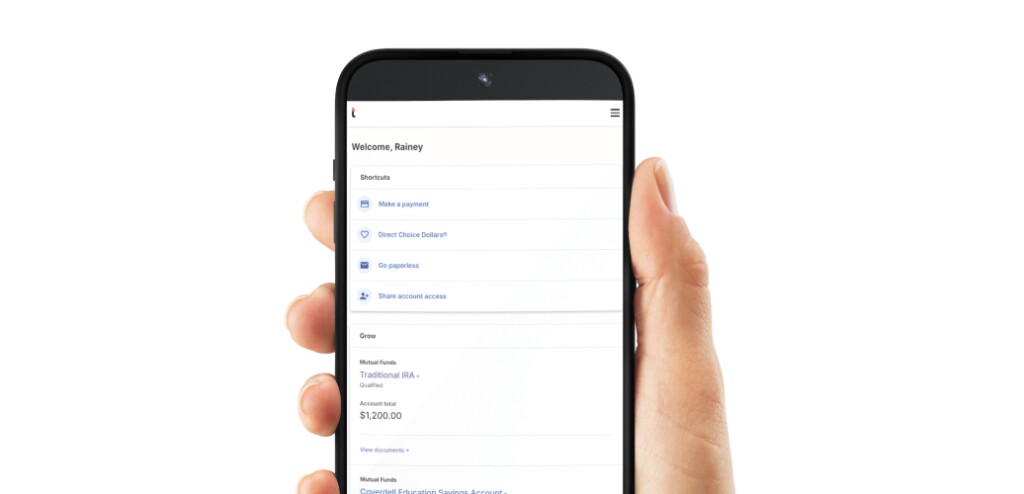

To invest in mutual funds, you'll need to open a

Once your account is set up, search for the mutual funds you're interested in, reviewing details like performance history, investment strategy and the fund's prospectus. Before purchasing, make sure you review the mutual fund fees, which are typically listed as the

By reviewing both expense ratios and potential loads, you can ensure that you're selecting a mutual fund with fees that align with your investment goals.

Basic types of mutual funds

Here's an overview of the basic mutual fund types, including stock funds, bond funds and index funds, along with a brief explanation of

Stock funds invest primarily in company stocks, aiming for capital growth; they come in different styles like growth, value, or dividend funds.

Bond funds focus on fixed-income securities like government or corporate bonds, providing more stability and income than stock funds.

Index funds are investment funds that aim to replicate the performance of a specific market index by investing in the same securities in the same proportions. They're just one example of passive funds, which lead to lower fees and generally more consistent returns in the long run. (Actively managed funds are managed by a professional with a goal of outperforming the market, often resulting in higher fees.)

5. Monitor your funds' progress

After investing in mutual funds, it's important to monitor their performance periodically. Look at annual returns, compare them to relevant benchmarks, and ensure they align with your original goals and risk tolerance. Over time, you may need to

Are mutual funds a good investment?

To evaluate a mutual fund, start by reviewing its past performance, focusing on annualized returns over several years. Compare these returns to relevant benchmarks, like the S&P 500 for stock funds. Analyze the fund's expense ratio, which represents the annual fees deducted from your returns. Lower fees generally lead to better net performance over time. It's also essential to assess the fund's risk profile by examining the types of assets it holds and the fund manager's strategy.

Mutual funds typically report annualized returns, which reflect the average return per year over a specific time period. While historical performance doesn't guarantee future returns, strong long-term returns relative to peers and benchmarks may indicate a potentially good investment.

Finally, consider how the mutual fund aligns with your investment goals, such as long-term growth or income, and understand the pros and cons of investing in them:

Pros of mutual funds

- Diversification. They allow you to

diversify by owning a broad mix of stocks, bonds or other assets, spreading out risk. - Professional management. Experienced managers make investment decisions for you, aiming to optimize returns.

- Low minimums. Many mutual funds have relatively

low initial investment requirements, making them accessible.

Cons of mutual funds

- Fees. Management fees (expense ratios) and potential sales charges can eat into returns over time.

- Taxes. Mutual funds may distribute capital gains or dividends that result in taxable income for the investor.

- Performance variation. Some mutual funds may underperform their benchmarks.