Making an investment plan introduces a whole new financial landscape. With the different types of savings, investment and retirement accounts, understanding your best options, and how each applies interest, can be confusing. How do new investors know what type of account to open and which type of interest to choose?

We'll dive into the essentials of simple vs. compound interest including definitions, account types, and real-world applications to optimize your financial strategy and help you grow wealth.

What is simple interest?

Simple interest is calculated based on your original investment or principal as opposed to compound interest which is calculated on the principal plus any accumulated interest.

Typically, financial institutions that provide personal loans, auto loans, student loans and mortgages use simple interest, although there could be some exceptions.

For instance, if you deposit $100 in a savings account that earns 5% interest annually, you will earn $5 in interest on your original investment every year, but no more, because it is based on your original investment.

$100 in savings account

+5% interest annually

=$105 balance after one year

What types of accounts use simple interest?

Some savings accounts—as well as certificates of deposit (CDs) and some loans—use simple interest.

CDs pay out the interest a customer earns on a regular basis. Sometimes, lenders allow customers to choose whether or not they want the interest earned added to the CD or deposited in another account they can use right away.

Some loans also use simple interest, including personal loans, student loans and auto loans. These loans are typically paid back over a shorter period of time than savings accounts, so the bank doesn't need to charge as high of an interest rate to make money.

What is compound interest?

With

Say you deposit $100 into a savings account that pays compound interest at a rate of 5%. After one year, you would have earned $5 in interest on your original investment, putting $105 in your account.

But in the second year, you would earn interest not only on your original $100 investment but also on the $5 in interest that accrued. This means you would earn a total of $5.25 in interest after two years. In total, you would have $110.25 in your account—your original $100 plus the interest earned both years.

With compound interest, you earn interest not only on your original investment but also on any accumulated interest, allowing you to reach your financial goals more quickly.

What types of accounts use compound interest?

Investment accounts and credit card companies typically make use of compound interest.

- Investment accounts, such as

brokerage accounts andretirement accounts , utilize compound interest to help grow the account holder's investment portfolio. - Credit card companies also use compound interest when consumers don't pay their balances in full.

Ultimately, compound interest is a powerful tool that can help you reach your financial goals. Be sure to take advantage of this tool by utilizing accounts that offer compound interest on your investments. And if you're ever tempted to carry a balance on your credit card, remember that the power of compounding interest can work against you, too.

What are the advantages of compound interest?

Compound interest can help you pick up momentum as you work toward your financial goals. When your earnings are reinvested and allowed to grow, you could earn more money than if you simply let your earnings sit in a savings account.

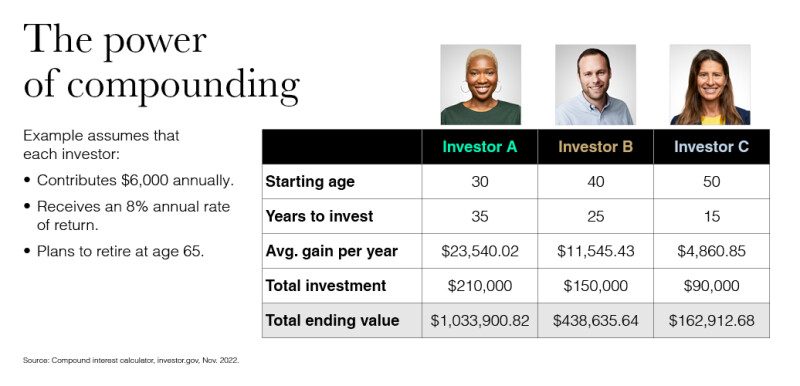

When it comes to compound interest, it pays to invest early and to stay invested. Money invested earlier and left alone to compound can result in a larger end result than a greater amount of money invested later with less time to grow. The moral of the story? The investor who starts early, contributes consistently and stays invested could have the best outcome at retirement age.

Another advantage of compound interest is that it can act as a cushion against inflation. Inflation is the rate at which prices for goods and services rise over time. Each year, your money will be worth less, and it won't buy as much as it did the year before.

Compound interest can help

What are the disadvantages of compound interest?

Compound interest can work against you if you have debt. Credit card companies often utilize compound interest to charge consumers more money. If you carry a balance on your credit card, the interest you're charged will be compounded, leading to an even higher balance. This can quickly get out of hand and lead to deep debt.

Another disadvantage of compound interest is that it can be complex compared with simple interest. However, taking the time to learn about how it works can reveal ways to make use of this tool and lean on its benefits.

Which is better for investors: Simple or compound interest?

Investors looking to grow their money over time should focus on compound interest. Unlike simple interest, which only earns on the principal amount invested, compound interest earns both on the principal and on the accumulated interest of previous periods. As a result, investors who take advantage of compound interest can see their money grow faster compared to those who don't.

Why is compound interest so important?

Compound interest is a powerful tool that can help you grow your savings and reach your financial goals. There are a few key reasons why compound interest is so important:

- It allows you to grow your savings more quickly. If you're looking to save for a major purchase, like a down payment on a home, compound interest can help you reach your goal faster.

- It's an easy way to boost your earnings without taking on any additional risk. With simple interest, you're limited to earning interest on your original investment. But with compound interest, you can earn interest on both your original investment and any accumulated interest, allowing your earnings to grow at an accelerated rate.

- It's a great way to plan for retirement. Because compound interest has the potential to grow your savings at an accelerated rate, it can help put your retirement goals within reach sooner.

Questions to ask your lender about interest

In addition to understanding how your lender calculates interest on particular accounts, it's also important to know how often the interest is "paid out." Paid out typically refers to either interest being added to your balance or interest deposited in another account (like an investment dividend is sent out to the investor).

Customers should consider lenders and accounts that pay out interest more frequently as this can help them experience greater financial growth as the interest compounds faster. If the interest is paid out less frequently (quarterly or annually), it's possible the account holder would not experience as fast of growth.

Bottom line

The main difference between simple and compound interest has to do with how interest grows. With simple interest, interest is paid only on the principal. The interest is not added to the account until the end of the term, so your principal balance will remain the same unless you make additional deposits. With compound interest, on the other hand, interest is paid not only on the principal but also on the accumulated interest from previous periods.

For that reason, it's essential to take advantage of compound interest when you can. If you have any questions on how interest fits into your financial strategy, reach out to a