In life, there are very few sure things. We dream, we plan—and then we hope for the best, because we never know what the future will bring. But what happens if your carefully laid plans get derailed by an untimely death? Will what you leave behind enhance the lives of others or create a financial hardships?

If you’re currently considering how to protect your loved ones in the event something happens to you—life insurance can be an important step to help ensure they can live on as planned.

Let's get started with the basics of life insurance, so you can make an informed decision for you and your family.

In this article, we'll cover:

An overview of how life insurance works The types of life insurance available How cash value works How do you know if you need life insurance? Common reasons people buy life insurance How much life insurance do you need? Do you need more life insurance if you have it through work? How much does life insurance cost? Tips for choosing a life insurance policy

What is life insurance & how does it work?

At its core, life insurance is a contract between you and an insurance company. You owe premium payments in exchange for your coverage.

If you die while covered by a life insurance contract, the life insurance company will pay the proceeds, or the

Common

- Your spouse or partner

- A child or children

- Parents

- Other financial dependents

A charitable cause

Some life insurance contracts offer additional benefits, such as cash value accumulation that you can access while you’re living.

The types of life insurance: Term & permanent

There are two main types of life insurance: term and permanent. The main

Term life insurance

- Term life insurance lasts for a set number of years. 10, 15, 20 or 30 years are the most common lengths.

- It is generally more affordable than permanent life insurance because it doesn't accumulate the cash value of permanent policies.

- If you die before that term is up, the death benefit is paid to your beneficiary.

- Some term policies allow you to

convert to permanent coverage while allowing you to maintain the original health rating policy, even if you have health issues or become uninsurable later.

Term policies often are used by parents who want life insurance until their kids are grown and financially independent. Term policies are also popular with people taking care of aging parents.

Permanent life insurance

- Besides having a death benefit, it may build cash value that you can access during your life to pay for expenses.

- Permanent policies often are eligible to earn

dividends .

People often use a permanent policy when putting together a complex end-of-life financial strategy. Adults with someone who always will be financially dependent on them, like a child with special needs, also find this policy useful. If you're worried about the ability to get insurance later on, permanent coverage may be a good option.

1. Whole life insurance

It also provides:

- Locked-in premium rates.

- Cash value that accumulates at a guaranteed interest rate.

- A death benefit that is generally income-tax free.1

- The potential to earn

dividends. - The option to add customized riders.

2. Universal life insurance

It also offers:

- Coverage that remains in force, as long as the contract retains cash value.

- Flexible premiums that let you shift as your budget and death benefit requirements change.

- Cash value that grows tax-deferred at a fixed interest rate.

- A death benefit that is generally income-tax free.1

Due to the flexible nature of universal life insurance, be aware that reducing your contributions can decrease both the cash value and death benefit of your policy. On the other hand, your life insurance contract can become a

3. Variable universal life insurance

Features include:

- Protection for your lifetime, as long as the contract retains its value.

- Tax-deferred cash value growth potential tied to the market. Market performance will impact your accumulated value either positively or negatively.

- A mix of diversified investment options to choose from.

- Adjustable premium payments. You even can skip a payment when money is tight.

- A death benefit that is generally income-tax free.1

What sets this policy apart is that it puts you in a higher-risk environment with the potential for gains or losses. If the market performs poorly, there’s a chance that a variable policy could lose all its value and terminate.

Like with universal life, note that using premium payment flexibility to reduce your contributions can decrease the cash value and death benefit of your life insurance (like with universal life insurance). It also can become a MEC and affect taxation if you make large, additional premium payments.

The living benefits of permanent life insurance

How the cash value component of life insurance works

In addition to the death benefit, permanent policies also offer the ability to accumulate cash value, positioning it as an investment tool and savings account you can tap into while you’re still living. Cash value provides the ability to borrow against the contract tax-free.

Cash value can help you:

- Provide additional savings for retirement.

- Pay college tuition expenses.

- Fund future expenses, opportunities or emergencies.

You can repay the loan as quickly or as slowly as you want. It even may be the case that you don't repay it at all depending on the type of policy and its current status.

There can be unfavorable implications of taking loans or withdrawals from your life insurance policy without paying them back. Why? Because when you take out a loan against the cash value, you’ll be charged interest and the death benefit will be reduced. If you don’t pay back the loan, over time the amount of the loan could exceed the value of the contract. You then could lose the contract and potentially pay taxes on the cash value.2

How do you know if you need life insurance?

Insurance is about protecting your current and future family and the needs that come along with life. If you don’t make it home from work tonight, financially what would happen to your family?

We recommend thinking through these five things when deciding if life insurance is right for you.

1. What are your family's immediate needs should you die?

2. How would your family be impacted without your income?

3. How do you plan to contribute to education?

4. What kind of legacy do you want to leave?

5. What traditions or life events do you want to make sure are supported?

Start by using this

You also may find it helpful to review common reasons people buy life insurance.

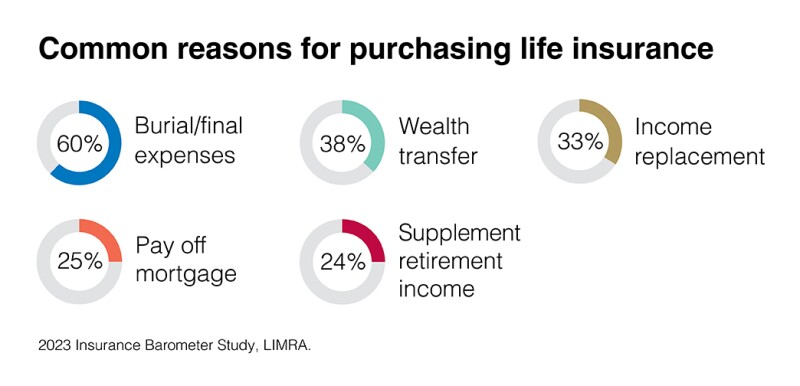

Why do people buy life insurance?

It’s pretty common in the U.S. to have life insurance, even if solely through a work policy. 52% of Americans reported having some life insurance, according to the

1. Pay for funeral & other final expenses

A big reason Americans buy life insurance is to pay for a funeral. Funeral costs can add up quickly. The median cost of a traditional funeral is $7,848, according to the

The death benefit can be used to help cover after-death final expenses such as:

- Funeral expenses

- Charitable contribution or memorial fund

- Time away from work to grieve

2. Protect family members who depend on them for income

Like many financial products, life insurance is about helping hedge risk. There’s a risk that an accident, disease or injury could end your life unexpectedly. It’s important to consider who would suffer if that happens. What would replace your lost income? Would your family have enough money to thrive?

For some people, there would be enough money in the bank to provide for loved ones. For others, there wouldn’t be nearly enough cash to make up for years of lost income or other support.

Life insurance payouts can be used to help cover ongoing and future expenses such as:

- Mortgage payments

- Childcare

- Living expenses

- Credit card bills

- College

3. Transfer wealth or leave an inheritance

If you want to

Discover other ways that life insurance can help with estate planning

4. Supplement retirement income

Permanent insurance can offer a way to provide income in retirement, making it an important consideration alongside your other retirement portfolio assets—401(k), pension, Social Security and so on.

Imagine you took out a permanent contract in your 30s and stayed current with premium payments until you retired at age 67. If sufficient premiums were paid, the cash value of that contract would have increased during those 37 years. If you no longer need the full amount of death benefit protection, you could receive payments from the contract’s cash value as a supplement to your other retirement income. And a portion of those payments potentially would be tax-free.

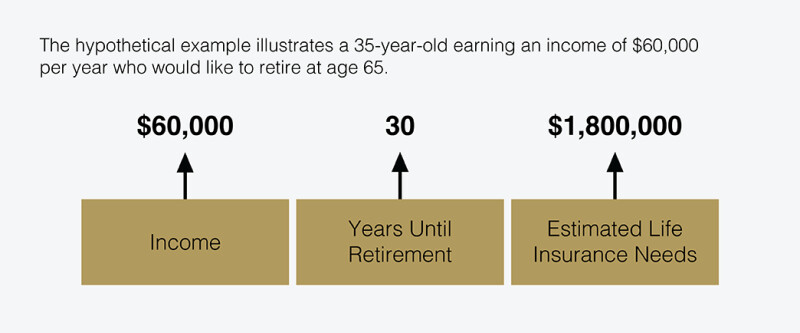

How much life insurance do you need?

A simple approach to help understand how much life insurance you need is to multiply your salary by the years until retirement. This simple calculation demonstrates the value of all future earnings that would be lost if you died today.

A financial advisor can provide a detailed, personalized estimate based on additional factors, including:

- Paying off your mortgage and other debt

- Funding education

- The impact of inflation

- Leaving a generational and/or charitable legacy

Do you need more life insurance if you have it through work?

If you have life insurance through work, it may not be enough, depending on your life stage. Your employer may not provide enough coverage to replace your lost income over a multi-year period, in addition to other family needs. Check if your group life insurance policy through work provides enough coverage to meet those needs.

Why crowdfunding doesn't replace life insurance

How much does life insurance cost?

Unfortunately, there isn’t a one-size-fits-all answer to the question of what life insurance costs. A process called

The good news is that life insurance may cost less than you think. According to the

Life insurance prices are determined by factors such as:

- Type of coverage—term life insurance is generally more affordable than permanent coverage. That’s because it’s for a set period of time versus your whole life. It also lacks cash value.

- Size of death benefit—large death benefits typically cost more than small death benefits. If you want a bigger payout when you die, then you’ll probably have to pay more.

- Your gender—men may pay slightly more than women for a similar life insurance policy. That’s because the average life expectancy of a man is shorter than that of a woman.

- Age, health and hobbies—the younger and healthier you are, the less you can usually expect to pay. While the more dangerous your job or hobbies are, the more you can expect to pay.

When buying a

Connect with a financial advisor to get a personal cost estimate for life insurance, after finishing your initial research online. They can assist with comparing costs and value across insurers. You also have the option to use an online cost comparison tool. In the end, you're looking for a quality policy at an affordable rate.

How to choose a life insurance policy

First, you will need to determine between term and permanent insurance. Ultimately, the choice comes down to your financial needs and budget.

- If you're looking for the most affordable way to provide support for your loved ones when you pass away, a term policy could be the right fit.

- If you're seeking a longer-lasting policy with a cash value component that grows over time, permanent policies can help cover a wide range of financial needs during your lifetime, from covering unexpected medical bills or a child's college tuition to supplementing your retirement income.

In addition, look for a policy from a reputable organization. Life insurance is a mid- to long-term commitment. So you'll want to consider a company that you have confidence in.

Connect with a professional

The life you’ve built is worth protecting. Find coverage that supports loved ones after you're gone. Connect with a