Life insurance is a crucial step toward providing a secure financial future for your loved ones after you die. However, not all life insurance contracts are the same. Two of the most common options, term and whole life insurance, offer different levels of security.

Here's a breakdown of the primary differences, including pros and cons, to help you determine which best aligns with your financial protection needs. We'll also answer some frequently asked questions about term and whole life.

This article covers:

How term insurance works How whole life insurance works Term vs. whole life comparison with pros & cons What is blended life insurance? Can you convert your term life insurance into whole life insurance? When should you buy both term and whole life? Which is better, term or whole life?

How term life insurance works

Term is the most affordable type of life insurance. Once the insurance is in place, you can lock in premiums so they won’t change for the term of the contract. As long as you pay the premiums, coverage remains in force during the term you select and benefits are paid at death.

How whole life insurance works

In exchange for this lifelong coverage and cash value, you generally can expect to pay more for whole life insurance than for term life insurance.

Term life vs. whole life comparison with pros & cons

Choosing between term life vs. whole life means weighing different pros and cons against your needs. While both life insurance contracts provide financial protection for your loved ones, there are five key differences to consider:

1. Cost of coverage

One of the biggest pros of term life insurance is that it offers the biggest bang for your buck if maximizing the death benefit is your priority. Because it's temporary coverage, premiums are significantly lower than whole life.

Because whole life provides coverage that can last a lifetime, premiums are typically more expensive, which some may view as the primary con of whole life. However, the cost difference is due to built-in features that term life lacks. Whole life premiums remain fixed throughout your life while term premiums could increase after the initial term ends if you choose to renew.

The bottom line:

- Term is the most affordable type of life insurance.

- Whole life is more expensive than many other types of life insurance.

2. Contract length

With term coverage, you can choose the coverage length to match your needs and budget. Contracts often last 10 to 30 years. You pay for the size of the death benefit you choose and the number of years of protection you want. At the end of the coverage period, you will have several choices, which may include converting to a permanent contract, if you want to continue coverage.

Whole life insurance is built to be a long-term plan. As long as premiums are paid, you're protected for your entire life. Once you have coverage, your loved ones will receive a tax-free death benefit, regardless of when you die.1

The bottom line:

- Term insurance lasts for a predetermined length of time.

- Whole life insurance lasts a lifetime.

3. Cash value component

The primary advantage of term life insurance is that it offers basic financial protection, providing a death benefit. This type of life insurance contract does not have a cash value component for potential growth or emergency needs.

The cash value component of a whole life insurance contract can provide additional financial security through guaranteed

The bottom line:

- Term life insurance does not have a cash value component.

- Whole life insurance is guaranteed to accumulate cash value.

4. Riders

Both term and whole life insurance contracts may allow you to add riders, which are extra benefits that customize the contract for an additional cost. Common riders include

Term life contracts may offer more flexibility in choosing and potentially removing riders as your needs change.

The bottom line:

- Both term and whole life offer customizable riders.

5. Potential for dividends

Term life insurance is straightforward. It provides some financial protection to your loved ones through the death benefit and does not offer

Whole life insurance policies are typically eligible to receive a dividend, which is a mechanism for the insurance company to return value to its policyholders. This benefit can enhance the overall value of your contract, allowing you to increase coverage, receive cash payouts or reduce your premiums.

The bottom line:

- Term life insurance does not offer dividends.

- Whole life insurance often pays dividends, though they are not guaranteed.

Term vs. whole life insurance comparison chart

| | Term life insurance | Whole life insurance |

Length of coverage | Specified period of time, typically between 10-30 years | Lifetime |

Cost | Initially lower rates | More costly than term life |

Premiums | Fixed | Fixed |

Cash value | No | Yes, and growth is guaranteed |

Dividends | Eligible, but not expected | Often earns dividends (but not guaranteed) |

Eligible for loans & withdrawals | No | Yes |

Death benefit amount | Fixed | Fixed, but can grow over time with certain dividend options |

Blended life insurance combines term & whole life insurance

If you feel like a mix of term and whole life insurance,

At the start of the coverage period, blended life insurance provides benefits similar to term coverage. If you die, it can help cover things like college costs, a mortgage or funeral expenses. As the contract matures, it gradually transforms into a whole life insurance contract, guaranteeing lifelong coverage as long as you keep up with premium payments. It also starts building a cash value component.

Because blended contracts include an initial term life component, premiums are often lower than those for traditional whole life insurance. If you're looking for dividends, it's worth noting that dividends (when received) are usually lower for blended life insurance than for a whole life contract.

Can you convert your term life insurance into whole life insurance?

If your term life insurance comes with a conversion option, you may be able to

When should you buy both term & whole life insurance?

When it comes to life insurance, choosing between term and whole life can feel like an either/or decision. However, having both types of coverage might be a wise financial strategy in some situations.

Combining term and whole life insurance could be the right solution if you have evolving insurance needs, a complex financial plan or a desire to maximize coverage. Here are three scenarios where this approach might make sense.

1. You bought a whole life contract with a too-small death benefit

You may have purchased a whole life contract several years ago, when your income and financial obligations were smaller. While the contract offers lifelong coverage, the death benefit may not cover your current needs.

In this situation, adding a term life contract could be a flexible and cost-effective way to address this gap, providing the coverage you need at a lower cost. If your financial obligations decrease over time, you could allow the term coverage to expire.

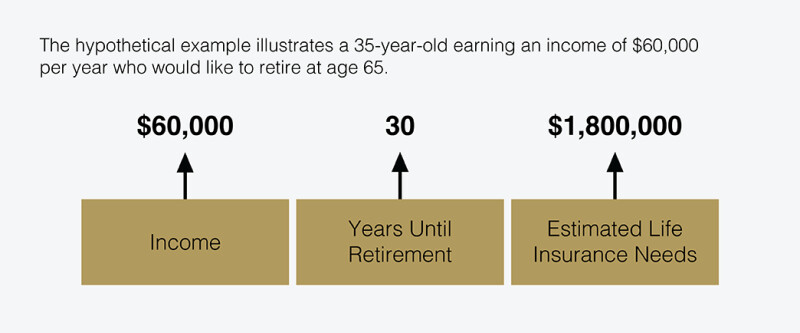

Not sure if you have the right amount of life insurance? Multiply your annual income by your years until retirement.

2. You are pursuing a 'ladder' strategy

Buying multiple life insurance contracts with varying lengths can be a cost-saving strategy. Usually, a ladder strategy stacks 10-, 20- and 30-year life insurance contracts on top of each other.

The strategy typically focuses on aligning higher coverage amounts with the periods of your life when your financial dependents rely on you the most. Then, according to your needs, it can provide less coverage and a smaller death benefit to your loved ones as time passes.

Managing this strategy can be more complicated than buying a single life insurance contract. You will have multiple bills to pay each month, and your estate executor will need to take an extra step after you die. However, the cost savings may make the extra work worth it for some. While laddering term insurance can save you premiums today, consider if this strategy will meet your coverage needs in the future if your financial situation changes. An alternative is to own one larger term contract that can be reduced as your needs decrease.

Whole life insurance may fit into a ladder strategy that includes a small contract. A whole life contract will provide lifelong coverage and ensure a minimum death benefit for final expenses or other end-of-life needs.

3. You want guaranteed coverage with potential cash value growth

Combining term and whole life insurance could be an option if you want a guaranteed death benefit for your entire life and the potential to build some cash value. However, with this approach, it's important to assess premium costs, cash value growth potential and death benefit payouts.

Term coverage can provide an affordable death benefit that can cover your loved one's immediate and short-term needs if something happens to you. A whole life contract, meanwhile, offers potential lifelong coverage and the possibility of accumulating cash value.

Having both at the same time can provide your beneficiaries with a large death benefit payout if something unexpected happens. Including whole life coverage also offers the potential to build a cash reserve you may withdraw from or borrow against when needed (although that could decrease your death benefit).

With this approach, you benefit from a guaranteed "base" level of lifelong coverage provided by the whole life contract, which covers any final expenses and estate needs no matter when you pass away. The temporary term coverage ensures your family is financially secure during the years when they depend on your income the most.

Explore all of the life insurance options available to you

Which is better: Term or whole life insurance?

This varies from person to person based on lifestyle, timeline, financial goals and strategy. However, if you're budget-conscious and term life is what you can afford, that may be the best option—some coverage is often better than no coverage. On the other hand, if you can afford more protection, you'll want to weigh your options more carefully and take into account cost, coverage and your overall long-term needs.

Here are a few situations to consider when comparing

When term life insurance may be better than whole life

- You're young. Purchasing term life at a young age can protect your future insurability—plus you can convert to permanent coverage when the time is right.

- You need an affordable option for your growing family. If finances are tight, term life insurance can provide more coverage at a lower cost than whole life insurance. It can cover funeral costs and provide financial support for your family, from replacing your income and paying a mortgage to helping cover college costs for your children.

- You're starting a business. Term insurance is a cost-effective option for business owners focused on growing their business while protecting their families and business partners. The appropriate life insurance can help ensure your small business lives on even after you're gone.

When whole life insurance may be better than term life

- You're looking for investment-like cash value. If you want to

maximize using the cash value of a contract for loans or withdrawing for income in retirement, whole life may be a good option for you.

- You want to leave a guaranteed death benefit to loved ones. As long as you pay premiums and don't have outstanding loans and withdrawals, your loved ones are guaranteed the death benefit amount that was agreed upon.

- You want an option that won't involve additional underwriting later in life. If you're worried about your family health history affecting your ability to get insurance later on, consider whole life insurance. Even if your health worsens, you'll have insurance.

- You're interested in dividends. You want a contract that often pays dividends (though they are never guaranteed).

Get professional guidance on life insurance

When thinking about your family's long-term financial needs, it's essential to ensure your income is protected now and in the future.

Choosing the right life insurance involves careful consideration of your financial goals, risk tolerance and how your needs might evolve. Whether term, whole life or a combination of both is the best solution depends on your unique circumstances.

Consulting with a financial advisor is the ideal way to determine the type and amount of coverage that makes the most sense for protecting your loved ones and building a secure financial future.

Ready to learn more about whether term or whole life insurance is right for you? Connect with a