When you’re faced with financial decisions to make, it’s crucial to consider your best interest. But you also want what’s best for the people you love—now, and in the future. And while you can’t predict what’s to come, you can prepare for it. Life insurance is one way to do that.

"We believe that your most important asset is the ability to earn income,” says Ryan Schwingler, a life insurance products consultant at Thrivent. “Term life insurance can replace lost income in the event of an unexpected death, so families can maintain the lifestyle they’re accustomed to.”

While there are numerous life insurance options to choose from, many people choose term life insurance for its affordability. Let’s take a closer look at its key features.

In this article, we’ll cover:

How term life insurance works Term insurance length options & how to choose The best age to buy term insurance How much term insurance do you need? Term vs. permanent life insurance: A comparison How blended term life insurance works Term life insurance FAQs Options at the term’s end Riders available on term policies Term life insurance pros & cons to help you decide

How term life insurance works

Term insurance lengths: Options & how to choose

You will often find term lengths of 10-, 15-, 20- or 30-year available, though it may vary by insurer.

“First, you need to understand how much death benefit would be needed to replace your income if you were to pass away,” says Schwingler. “Then select the appropriate length of coverage that works with your budget.”

Another consideration is that if you have a need for protection that will go away after a certain time. Say you have 27 years left on a home mortgage, Schwingler says. A 30-year term life insurance contract ensures that your family can make those payments even if you’re gone. Likewise, you might choose a contract to last through your children’s growing up years.

On the other hand, there are some pitfalls to avoid when selecting a term length.

Mistakes to avoid when choosing a term length

On the other hand, there are some pitfalls to avoid when selecting a term length:

1. Overlooking inflation and future needs. As the value of a dollar fluctuates, there's a chance the purchasing power of your protection amount won't stretch as far when it comes time for your family to access it. You also don't want to undercount the expenses that will crop up.

2. Being under- or over-insured. You can always buy a longer term than you think you might need while being mindful of what it means for your budget. It's a matter of balancing how much risk you take on versus the insurance company. Generally, you can reduce the death benefit of term coverage at any point. When the death benefit is reduced, premiums are decreased.

We believe that your most important asset is the ability to earn income. Term life insurance can replace lost income in the event of an unexpected death, so families can maintain the lifestyle they’re accustomed to.

What is the best age to buy term life insurance?

Term coverage may be smart at a time in your life when you need protection, but you aren’t able to afford permanent life insurance. Generally, the younger and healthier you are, the lower your rates will be.

Term insurance may make the most sense when:

- You’re young. Purchasing term life at a young age can protect your future insurability, plus you have the option of converting to permanent coverage when the time is right.

- Your family is growing, or you have children living at home. At a time when you and your family find finances tight, term insurance can provide a large amount of coverage at a lower cost than permanent insurance. The insurance can cover funeral costs and provide financial support for your family, from replacing your income and paying a mortgage to helping cover the costs of college for your children.

- You’re starting a business. It’s a cost-effective option for business owners who are focused on growing their business while protecting their families and business partners. Having the appropriate amount of life insurance can help ensure that your small business lives on—even if you are gone.

How much term insurance do you need?

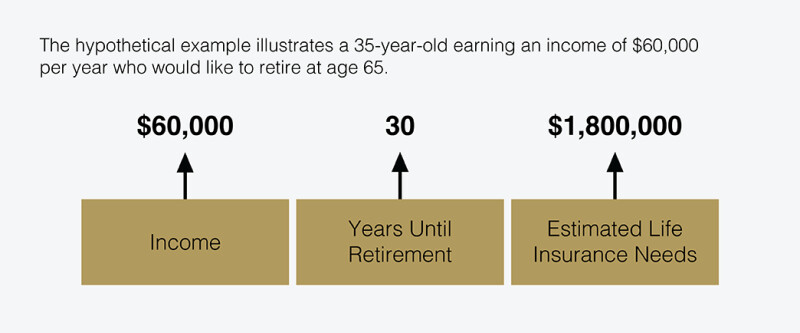

A simple approach to help understand how much life insurance you need is to multiply your salary by the years until retirement. This simple calculation demonstrates the value of all future earnings that would be lost if you died today.

When considering an amount that’s right for you, think about your goals and income potential, how long your loved ones may need financial support and your current liabilities, such as a home loan, student loans, credit card debt and other obligations. Also, take into account future education expenses for your children and your hopes for leaving a legacy.

Comparing term vs. permanent life insurance

Term insurance covers you for a specific period of time at less cost, while permanent insurance typically lasts for your lifetime and builds cash value. Cash value is a reserve in your contract that grows over time as long as premium payments are made.

You can think of term life insurance as temporary coverage while permanent life insurance offers lifetime protection. In exchange for the lifelong coverage and cash value that comes with permanent life insurance, you can generally expect to pay more.

Related:

Term vs. permanent coverage at-a-glance

| | ||

| Coverage period | Specified term | Lifetime, as long as premiums are paid, and the contract retains value |

| Cost | The most affordable type of life insurance | Costs more than term due to additional features |

| Premiums | Fixed premiums during term period | Flexible premiums on some types |

| Cash value | Doesn’t not accumulate cash value | Potentially provides cash value growth |

| Death benefit | Provides a death benefit to give beneficiaries financial support | Provides a death benefit to give beneficiaries financial support |

What is blended term life insurance?

Blended life insurance is a single product that combines the benefits of term and permanent life insurance. At the start of the contract, it provides benefits similar to term coverage. It can help cover things like college, a mortgage and funeral expenses if you die. Further into the contract, this type of policy starts to act more like whole life insurance (though premiums tend to be lower), offering cash value that you can access while you’re alive.

Frequently asked questions about term life insurance

Here we answer some of the most common questions about term insurance policies:

How does the term life insurance application process work?

When you apply for life insurance, you'll be asked to fill out paperwork and answer medical and non-medical questions. Many insurers also require a short medical exam. You could face additional testing depending on your age, your desired contract or your medical record.

Read on for full details:

Do term life insurance policy premiums increase?

Term life premiums are typically level and will be the same for the duration of the contract. This can make it easy to plan for your life insurance premiums in your budget.

How does term life insurance pay out?

When you think of life insurance

- Periodic payments for a certain number of years.

- Periodic payments of a certain dollar amount.

- Flexible payouts – they decide how much and when.

- Lifetime payouts – guaranteed income as long as they live. This option can include a joint payout for two people.

Do you get your money back at the end of the term?

If you’re still alive when your term life insurance policy expires, there is no financial payout or cash value. The premiums that were paid into the contract were used for the protection that the death benefit would provide in the event of your death. If you are looking for a policy that provides a cash value feature, consider a

Still not sure if you need life insurance?

Options at the term's end

Term life insurance is built to last until the end of the time period you selected (usually 10 to 30 years). On the expiration date, you’ll be faced with four choices:

1. Convert to permanent life insurance

Instead of letting your term life insurance policy expire, you may be able to exchange it for a permanent policy without needing a new medical exam.

2. Renew the term life insurance contract

Depending on the type of term life insurance you buy, you may be able to extend your contract when the term is over. Some insurers offer a year-long extension to your existing coverage. You may be able to renew each year for an increased premium.

Why is a

Renewability is a topic to discuss with your financial advisor as well as which type of life insurance may be right for you if you anticipate major life changes during the term of your policy.

3. Open a new term or permanent policy

Sometimes it makes sense to buy additional protection or buy a different type of policy. However, a new policy means going through a new medical exam and underwriting which means you could be placed in a different health classification. If your health has worsened and you need coverage, a conversion may be your best (or only) option.

4. Go without life insurance

You decide that your financial obligations are in a place where you no longer need life insurance coverage.

What riders are available on term policies?

Depending on the insurer, there may be riders available on your term insurance contract, including:

Accelerated Death Benefit for Terminal Illness Rider : This may be a standard feature versus an optional rider on your term life insurance policy. It pays the death benefit if you have a life expectancy of 12-24 months or less (depending on state), as certified by your qualified physician.

Disability Waiver of Premium Rider : This is an optional rider available for an additional cost. It allows premiums to be waived if you become totally disabled, as defined in the contract.

Term life insurance pros & cons

To recap, let’s review the pros and cons of term life insurance to help you decide if it’s right for you.

Term life insurance benefits

The benefits of term life insurance include affordability, the option to convert to permanent insurance and the possibility of a renewing your contract.

- It’s generally affordable. You aren’t paying for extra features and can get the largest death benefit possible for your money.

- You may have the option to convert to permanent insurance later. If you decide that permanent insurance fits your need, you may be able to convert some of all of your contract to a permanent life insurance policy without a new medical exam.

- It may be renewable. If your insurer offers it, when your term is close to ending, you may be able to renew or extend your existing contract.

Term life insurance drawbacks

The potential downsides of term life insurance are that it ends after a set time period, and it doesn’t build cash value.

- The coverage is temporary. After the term ends, your coverage will end unless you convert or renew.

- There is no cash value accumulation. If you outlive the term you selected, your coverage will end and you won't receive money back.

- You may need to go through underwriting again at the end of the term. If you decide to open a new term policy after the end of coverage, you risk health changes increasing your premium amount or being uninsurable.

Is a term life insurance policy right for you?

Choosing the right life insurance today is the first step in protecting and preparing your family for whatever lies ahead. A term life policy provides protection now and gives you options for changing your coverage as your life changes. It can be a worthwhile way to financially protect your family should you die.

Connect with a