If you’re at or near retirement, you’ve likely given a lot of thought to Social Security: how much you’ll receive, when to start taking it, and the role it will play in your overall income in your post-working years. But what you may not have considered are the

What determines whether I’ll be taxed on Social Security?

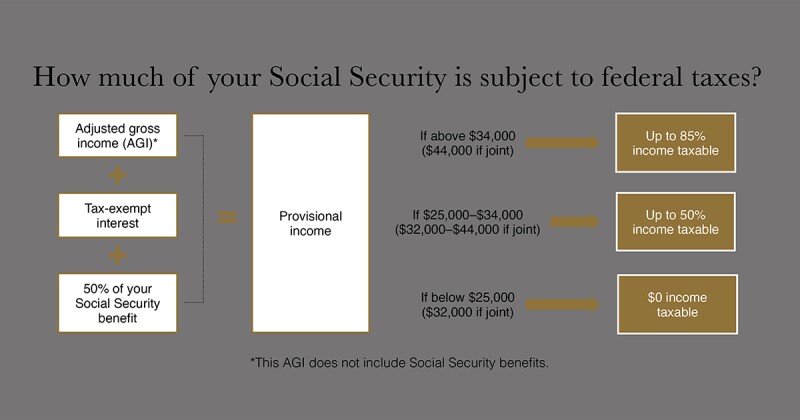

To determine if you’ll owe taxes on Social Security—which is dependent on your income and filing status—take half of your Social Security money collected during the year and add it to your other income from pensions, wages, interest (including tax-exempt), dividends and capital gains. If that total is between $25,000 and $34,000 for an individual or $32,000 and $44,000 for a married couple filing jointly, up to 50% of your Social Security benefits are subject to taxation. For those with a higher income, up to 85% of Social Security benefits may be taxable.

How do Social Security taxes fit into my larger tax efficiency strategy in retirement?

By working with a financial advisor and being strategic about where you pull your retirement income from, you may be able to reduce the amount of taxes you owe on Social Security. “Ideally, you would have tax diversification, which means you have money in different tax categories:

For example, you might opt to withdraw a portion of your retirement income from a Roth IRA or Roth 401(k)—instead of a traditional IRA or 401(k)—since that money isn’t considered taxable income upon withdrawal. “Having money in different tax categories gives you the flexibility to manage your Social Security taxation year over year,” Berg says.