When securing financing for a large purchase or project—such as for a house, a car or to do home improvement—it helps to have a good FICO

A low credit score will make it more difficult to secure credit, and if approved, your interest rate may be higher, as you’re considered a riskier borrower—which results in paying far more in interest charges over the lifetime of the loan. However, the higher your credit score, the better your interest rate may be and the quicker you’ll be approved.

So, how exactly can you improve your credit score? Below, you’ll find five tips to give your score a boost.

1. Set up automatic payments.

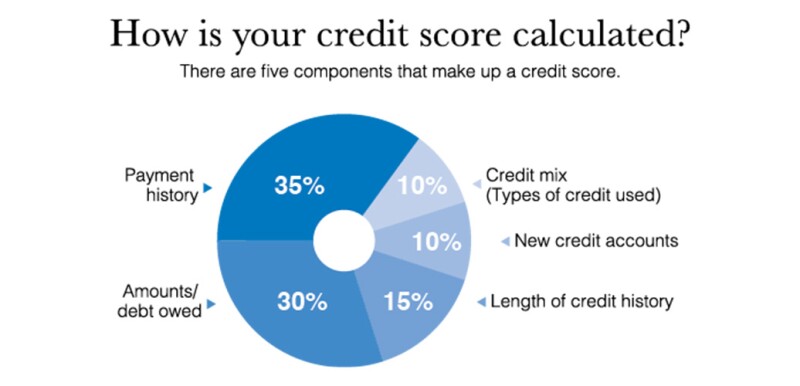

This helps ensure you pay bills, loans and credit cards on time. Timeliness with your payment history has the largest effect on your credit score.

2. Don’t get close to your credit limit.

A good rule of thumb is to keep your credit usage at 30% or less of your overall credit limit. This credit utilization rate, or debt-to-credit ratio, is calculated by taking the amount of revolving credit you use divided by the total credit available to you. To reduce your debt-to-credit ratio, make a concerted effort to pay down your credit card debt or loans. You also could ask your creditor for a credit line increase to further lower your debt-to-credit ratio. (Just make sure you don’t start increasing your credit usage along with that increase.)

3. Maintain long-running accounts.

The length of your credit history matters—so, avoid closing accounts, even when balances are paid off.

4. Add to your credit mix.

Maintaining different types of credit will have a positive effect on your score (i.e., a mortgage, a car loan, student loans and credit cards). Having only one type of credit, especially if it’s just credit cards, reflects negatively on your credit score. That being said, only apply for credit that you need, and don’t apply for new credit often. This helps you maintain a healthy debt-to-credit ratio and avoid hard credit checks, which can temporarily lower your credit score.

5. Check for errors.

It’s important to keep an eye out for inaccurate information on your credit report, which affects your credit score. Under federal law, you’re entitled to one free credit report annually from each of the three nationwide consumer credit reporting agencies (Equifax, Experian and TransUnion). You can access all three at