Saving for retirement in your 40s comes with both opportunity and pressure. You still have time to make meaningful progress, but life in this decade can be financially complex. Mortgage payments, caring for aging parents and everyday expenses all may be competing for your attention. That's what makes your 40s such a pivotal time to pause and reassess your retirement strategy.

Before you move forward, it's important to understand where you stand today. While retirement may still feel far off, the decisions you make now can help shape the future you envision.

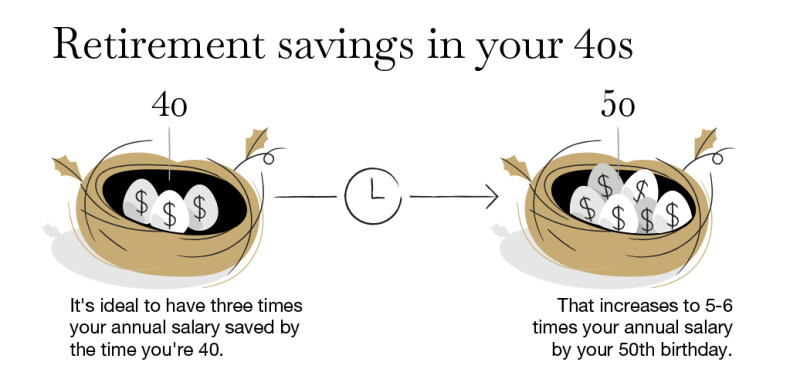

How much should I have saved for retirement by 40?

Many financial experts recommend having at least three times your annual salary saved by age 40 as a retirement savings benchmark. By the time you turn 50, your retirement savings balance should be up to six times your annual pay. According to the Survey of Consumer Finances, the

That may or may not be enough depending on your financial circumstances and goals. It's hard to pinpoint how much you should have in your 401(k) at 40, but guidelines and averages can give you starting points. Adjust them to fit your lifestyle, budget and priorities so you can reach your retirement goals on the timeline you choose.

What if I have less saved for retirement at 40 than I should?

Age-based targets are helpful guideposts to help you chart your course—not rigid rules. If you're behind at 40, don't panic you still have a lot of years of saving ahead of you to build momentum. Rather than drastic savings measures that aren't sustainable, make small, manageable changes to the way you approach money and give yourself time to close the gap.

Start by reviewing your budget to find ways you can increase your retirement contributions. You don't have to cut all the fun from your spending, but reprioritize so that you're working toward both

As long as you're making progress with your retirement savings, you're better off than delaying saving or not saving at all.

Step-by-step guide: How to save enough for retirement by age 40

If your goal is to have three times your annual salary saved for retirement by 40 and six times by 50, you'll need a focused retirement savings strategy to get you there. Here are some practical steps to help you build your retirement nest egg in your 40s and stay on track for long-term financial security.

1. Start early: How time and compound interest grow your retirement savings

For long-term investments like retirement,

- Let's say you're just turning 40 and can afford to save $500 per month for retirement in an account that's projected to have a 7% average annual return rate. By age 65, you would have contributed $150,000 and earned $229,494 in compound interest for a balance of $379,494.

- But maybe you're also thinking about holding off to start to save heavily for retirement until 50, when you think you'll be able to put away $1,000 per month with the same average annual return rate. By age 65, you would have contributed more — $180,000 — but only earned $121,548 in compound interest for a balance of $301,548. (Examples are based on the

interest calculator at Investor.gov .)

The earlier you start saving, the more you benefit from compound interest—one of the most powerful tools for long-term growth.

2. Maximize employer-sponsored retirement plans like 401(k)s and 403(b)s

Specially designated retirement accounts let you save a sizeable amount of money every year and take advantage of either tax-deferral now (traditional accounts) or tax-free withdrawals later (Roth accounts). As a work-related benefit, employers may offer a

TIP: Be sure to get the matching employer contributions

If there's an

3. Automate contributions and gradually increase your savings rate

Automatic savings contributions, whether it's from your paycheck or a scheduled bank transfer, reduce the temptation to spend extra money. It helps to look at your budget for

4. Boost retirement savings with a traditional or Roth IRA

If you aren't covered by a retirement plan at work or have contributed the maximum and want to save more, an

The best type of IRA for you depends mostly on your current and expected future tax liabilities:

Traditional IRAs provide an upfront income tax deduction when you contribute, and taxes are deferred until you make withdrawals.Roth IRAs don't reduce your annual income for tax purposes, but your after-tax contributions won't be taxed again. Plus, any earnings may be entirely tax-free when you take qualified withdrawals.

IRAs also serve as a

5. Explore additional investment options beyond retirement accounts

Employer retirement plans and IRAs aren't the only way to

In your 40s, taking investing risks isn't necessarily a bad thing, but make sure you know about the potential benefits of tactics like

6. Use a health savings account (HSA) for tax-free retirement healthcare

Smart retirement savings strategies for your 40s

Here are a few more ways to save for retirement in mid-life that don't involve major lifestyle changes to meet your savings goals.

Use budgeting to find savings opportunities

A

Budgeting doesn't mean you never get to indulge and splurge, but reviewing your expenses can help you identify which ones are less of a priority to you than having a secure financial future.

Adopt the 'pay yourself first' method to prioritize saving

The

Balance debt repayment with retirement contributions

If you carry a credit card balance or other debt, it's crucial to balance paying what you owe with your essential spending and your future saving. Accounts that go unpaid may rack up fees and interest, but you also don't want to neglect your savings for the sake of paying off every debt. As you work through

Prepare an emergency fund to protect your retirement savings

Use insurance to protect your retirement plan

Consider having some protective coverage, such as