Sure, it’s important to save for retirement. But other major priorities, such as your kids’ tuition, or a big wedding to plan, could throw you off course.

So now that you’ve been at it for a while and have grappled with all kinds of expenses, you may be thinking, “Will I have enough to live the retirement I’ve planned?” If you’re willing to make some changes and a few sacrifices here and there, you’ll find that retirement doesn’t need to be an either/or proposition.

Let's take a look at some typical challenges to retirement-savings success—and how you can address them while keeping your retirement savings humming along.

6 common challenges affecting your retirement savings plan

Roadblocks happen. Understand the common challenges to maintaining your retirement savings plan by taking a look at them one by one and deciding if they should take precedence over your security in retirement.

1. Not following a budget

It may almost sound too simple to list. But when your household lacks a sound spending plan, your savings are bound to suffer. While there are many

2. Lack of emergency savings

No household should be without an

3. Carrying ongoing debt

Debt is one of the most common retirement-savings challenges—particularly non-secured debt, such as credit card balances and student loans.

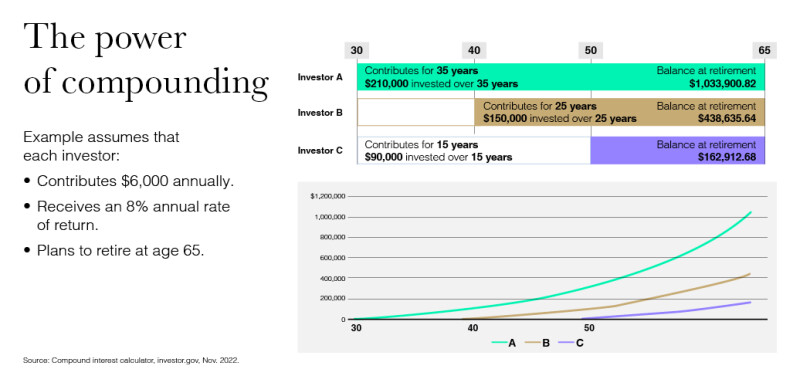

You may be thinking “I can’t really save for retirement until I’m debt-free.” But that kind of first-this-then-that approach to retirement planning could waste valuable years of gaining compound interest on your retirement account balances. What’s more, if you pay off your debts while also saving, your savings’ compounded growth may exceed your debt’s compounded interest. And that’s just what you want.

4. Sudden changes in household expenses

Perhaps you’ve had some totally unexpected expenses to manage. Consider these possibilities:

- Your adult child returned home after losing their job to work on “next steps.” (If so, you’re in good company. According to a Thrivent Boomerang Kids Survey,1 40% of parents report having an adult child who is currently living with them. And 26% had an adult child who was temporarily living with them but then moved back out. Read more about

how to manage your finances when an adult child has needed to move back in.

- Your parents have moved in with you and your family due to budget concerns. You’re pitching in for their medical and everyday expenses.

- An unexpected surgery has suddenly saddled you with a five-digit hospital bill for out-of-network charges.

If you don’t have sufficient emergency funds, such expenses may have you considering a

5. Contributing to college savings or costs

Perhaps you’re staring down the dilemma of saving for and managing rising your children's college costs. In Academic Year 2024-2025, American parents contributed

It’s possible to contribute to your kids’ futures while not shortchanging your future financial security.

6. Prioritizing other short-term savings goals

Savings isn’t just about rainy days and retirement. You’ll want money already set aside for when your children get married, you want to buy a new car or a lake house, or take a big vacation for your 25th wedding anniversary. Budgeting can help you provide for your family’s most joyful moments while keeping to your savings plan.

The ultimate guide to retirement savings by age

7 ways to stay on track with your retirement goals

You’d be surprised at how much you can still accomplish financially when you have a plan to follow. Here's how to work through those roadblocks.

1. Set and maintain a realistic household budget

Without a budget, you’ll have no way of knowing if you’re balancing spending, saving and debt management. Start by tracking your expenses for a month, without making any changes in your spending habits. Then, see where you may be overspending and how you can redirect that cash towards your retirement goals. Keep experimenting month to month. And remember, you’re likely going to earn more in your career, which will give you even greater savings flexibility.

- Learn more:

Why budgeting is important: 5 key benefits

2. Make compound interest work hard for you

Sure, you may not always understand all the nitty-gritty details of how

How can you take full advantage of this secret weapon? Contribute regularly to your plan—no matter how little you’re able to deposit—and leave it alone. You could be amazed at the results if you give yourself time.

3. Max out your 401(k) & IRA contributions

You hear this one all the time, and there are at least four great reasons for

- You’ll reduce your adjusted gross income (AGI), giving you more money for your shorter-term financial goals, like household savings or making a large purchase.

- The more you contribute as early as possible, the greater the opportunity for compounded growth. It can be a great

hedge against inflation , one of the most significantrisks to your retirement income plan .

- If you’re 50 or older, you can make larger

“catch-up contributions” to save on taxes and increase growth potential. If you have a 401(k) or traditional IRA, the money may be deductible from your taxable gross income for the current year as it grows tax-deferred in your account.

- You don’t want to leave

matching funds from your employer on the table—it’s truly “free money.” Even if you can’t max out every year, matching funds help in compensating for those times.

4. Size up your debt & make a plan to wipe it out

Having debt is no reason to put off retirement savings, especially if your debt is relatively low-cost. However, in some cases, student or consumer debt may stand in the way of savings that you need for your life goals and retirement vision. Luckily, you have options.

Pay off your debt, starting with the highest interest rate loan first and moving down the list. Automating your payments can make the process easier. You’ll be surprised how much it reduces the pain when you don’t have to hit “send” manually.

Consider if refinancing a student loan or consumer debt could help you lower your interest rate. You can either keep the same monthly payment and pay off the loan faster or lower the monthly payment (which extends the loan’s duration and total cost). You may want to convert a variable interest rate to a fixed interest rate.

5. Automate your household savings contributions, including emergency savings

When you set up a small automatic savings deduction, chances are you won’t even notice the pinch. You may even want to make deposits to a separate bank that doesn’t provide immediate access to your cash, as a deterrent against impulse withdrawals.

6. Make the most of bonuses or inheritance

Raises and less-expected windfalls such as an inheritance or a tax refund are a great opportunity to balance out your savings. Split the net proceeds among your highest-interest debt, retirement accounts, emergency savings accounts and maybe 10% or so towards a want. That way, you’re covering all of your priorities, while also not depriving yourself of having some fun right now.

7. Create a college savings strategy with your children

Will you pay for some or all of your child’s college education? If the answer is “some,” what other sources can fill the gap? Grandparents’ contributions, children’s savings and scholarship programs are just a few options you can build into your plan. Start talking about college with your kids early on. This sets a firm foundation for more specific discussions in high school about their goals and your expectations.

- Learn more:

What college savings plans are available?

Creating a strong retirement savings plan

No matter how well you plan, you will more than likely face challenges to your retirement goals. When this happens, you can incorporate some of the strategies and tactics we’ve discussed here to help stay on track with your retirement goals.

Use our