Now that you're in your 30s, you likely have several years of work behind you and increased earning potential ahead. Now is the ideal time to start or accelerate smart saving practices you can use for years to come. Saving now gives your assets more time to grow into the nest egg you'll need for a comfortable, fulfilling life.

Here's what you can do to save for retirement in your 30s—even if you have competing financial priorities.

How much should you have saved for retirement by your 30s?

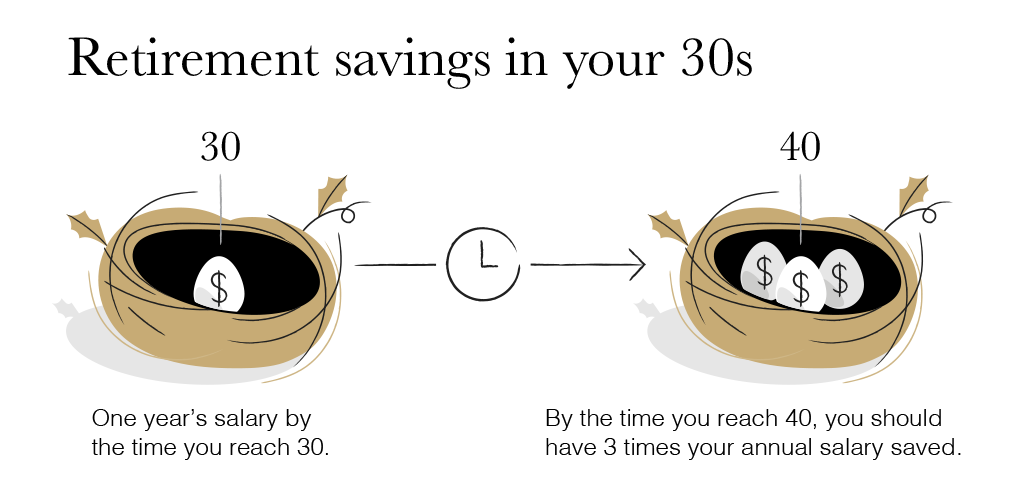

Our guideline for someone who's 30 and expects to retire in their 60s or later is to have at least one year's income saved. The recommended benchmark for

Let's use the Bureau of Labor Statistics'

Keep in mind that estimating your retirement savings by age involves a lot of factors that are personal to you. The guideline isn't the universal goal for everyone. In fact, according to the Federal Reserve, the

People in their 30s often have competing financial interests, so it's understandable if you don't feel on track for retirement. Use recommendations and averages as general guideposts as you continue saving for the retirement you want. It's not easy to estimate how much you'll need for retirement. But even in your 30s, you can sketch out long-term goals, so you have an idea to start working toward and measuring against.

Curious about the savings milestones for other decades?

Why should you save for retirement in your 30s?

When it comes to saving for retirement, time is your greatest ally. Every dollar you invest in your 30s will be worth more in retirement than a dollar you contribute later in life. Why? Because you'll benefit from

You don't have to wait until you can save a lot to start investing for retirement. Even a small amount at age 30 can go a long way. That's because your money can grow—and then the growth itself can grow, too. It's the power of reinvesting, and it adds up over time.

Example of how compound interest helps you in your 30s

This chart shows how powerful compounding returns over time can be:

| Starting small at age 30 and steadily continuing to age 67 | Starting later at age 35 with a bit more and continuing to age 67 | Starting at age 39 with an even bigger amount and continuing to age 67 | |

| Monthly contribution | $300 | $400 | $500 |

| Years dollars are invested | 37 | 32 | 28 |

| Total contributions | $133,200 | $153,600 | $168,000 |

Projected value at age 67 with 7% average annualized returns* | $577,214.65 | $529,047.14 | $484,186.15 |

In this example, a person who starts with a smaller amount at age 30 and contributes that amount steadily over 37 years can turn a total of $133,200 in contributions into $577,214.65 in retirement money. Someone who waits until age 39 but puts in more per month would still end up earning less, turning a total of $168,000 in contributions into $484,186.15.1

The best ways to save for retirement in your 30s

Reaching a retirement savings goal requires more than stashing money in a standard savings account.

1. Use tax-advantaged retirement accounts

Usually, the best option to maximize first is a

Here are the most common types of retirement accounts you may be eligible to contribute to:

401(k)s & more: Retirement savings through your employer

If you work for an employer that offers a retirement plan, it's usually the most logical place to start. Depending on the type of employer, the plan may have a different name and slightly different rules.

401(k) plans: Offered by privately held and publicly traded companies403(b) plans: Offered by public schools, churches and certain nonprofits457(b) plans: Offered through state and local governments and certain nonprofitsThrift Savings Plan s: Offered by the Federal government

The key benefits of contributing to employer-sponsored retirement plans:

- Automatic deductions from your paycheck ensure you contribute consistently.

- Many employers will

match a portion of your contributions, which is essentially free money. - Some employers make

discretionary contributions that aren't tied to how much you contribute. - High contribution limits. You can contribute up to

$24,500 in 2026 to any of these plans.

Consider starting with an amount that feels affordable. It's wise to contribute at least enough to get the employer match as a start. As you get used to setting aside money, set a goal to bump up your savings rate each year to build your retirement fund even more.

If you work for a small business, your employer might offer a type of plan called a

All employer plans allow traditional (pre-tax) contributions. Some also allow Roth (after-tax) contributions, such as a

Are you self-employed?

Individual retirement accounts (IRAs): A way to save for retirement without an employer

IRAs can be opened by anyone with earned income at any financial institution that offers them. They can help if you don't have a workplace plan, and you also can use them to save more if you do have a workplace plan but want to save beyond its limits or choose investments it doesn't offer.

The two main

Traditional IRAs let you invest money, potentially lowering your taxable income today. Then, when you start withdrawing in retirement (after age 59½), the money is taxed as income. If you expect to be in a lower tax bracket down the road, this approach could work in your favor.Roth IRAs are funded with money you've already paid taxes on. The big perk? Your money grows tax-free, and qualified withdrawals, after age 59½, come out tax-free, too. Plus, you can access your contributions anytime without penalty, giving you added flexibility along the way.

The annual IRA contribution limit if you're under age 50 is $7,500 in 2026 whether you have one IRA or

Health savings accounts (HSAs): Saving for health, investing for retirement

The primary purpose of a

2. Make saving for retirement part of your budget

Creating and sticking to a monthly

Following a budget doesn't mean slashing all discretionary spending. You're more likely to stick to your plan if you make room for things you enjoy, like going out for lunch, and things you care about, like donating to your church. Just be careful to avoid

3. Increase your savings by "paying yourself first"

Use the

The easiest way to do this is through a payroll deduction to your employer-sponsored plan or by setting up electronic deposits into an IRA or other account. Figure out what you can realistically and consistently contribute each month while keeping on top of your regular expenses.

4. Plan for the "what-ifs"

What would happen if your car broke down, you got laid off, or you had to stop working while getting cancer treatment? To avoid dipping into your retirement savings or taking on high-interest debt, it's wise to have an

Having

Another protective action to take for your future is having enough

5. Use financial windfalls wisely

Be sure to put any cash windfalls you receive to good use. If you get a tax refund or a year-end bonus, it's only natural to want to splurge on something fun. But you can use a portion of those funds to give your retirement account a one-time boost or add to your emergency fund. You might even find it easier to set aside this money because you weren't accounting for it in your budget. You can leap ahead on your long-term savings goals without sacrificing your existing lifestyle.

6. Start investing in your 30s

Saving money for retirement is foundational, but you'll need to invest to beat inflation and grow your net worth. Don't let investing intimidate you: You don't need to analyze stocks or follow the Nasdaq. Most people do best when they know just enough to make time-tested choices and don't try to beat the market.

Consider these investments as part of your overall retirement portfolio:

Target-date funds contain a mix of stocks and bonds. They're more aggressive when you're younger and become more conservative as you approach your target retirement date. They can be a good set-it-and-forget-it option.Mutual funds andexchange-traded funds (ETFs) make it easy to build adiversified portfolio. These funds let you own a basket of securities through a single investment.Index funds and index ETFs aim to offer the same return as a broad index, like the S&P 500, short-term government securities or the total bond market.

Look for funds with low

Gauge your risk tolerance as a 30-something

Determining your

In general, people in their 30s can afford to take on more risk. You have plenty of time to learn from your investment decisions, both good and bad. Your portfolio also has more time to benefit from long-term growth potential despite short-term market fluctuations.

Your risk tolerance may change over time. So will your perspective and priorities. As you get closer to retirement age, you may put more of your money in safer investments. Keep in mind that risk is always a factor with financial investments. But investing with an end goal in mind can help keep you on track.

Understand that market volatility is a natural part of investing

In the short run, your investments may change dramatically in value. These swings often cause

When you're in your 30s, you may want to ride out these waves of

Get more insight into investing during market volatility

Make your retirement vision a reality

Saving and investing for retirement requires a lot of work upfront, but it doesn't have to be a chore. Take one step at a time, and eventually, you'll have your plan on autopilot—checking in periodically to make sure you're on course and increase contributions if you can. Of course, you can be more involved with your retirement investment strategy. But retirement accounts are designed for people at any investment level to easily store up money for decades until it's needed for your post-working years.

When getting started with retirement planning, consider working with a professional to make a roadmap based on your individual goals and values. With a

____________________

1 Hypothetical examples are for illustrative purposes. May not be representative of actual results.