A 401(k) plan is one of the most common retirement savings options for Americans who work in the for-profit sector. If your employer offers one—or if you work for yourself—you stand to enjoy far greater financial security by learning the ins and outs of how 401(k)s work and understanding why it's generally a good idea to contribute if you're eligible.

What is a 401(k) & how does it work?

A 401(k) is the most common type of employer-sponsored retirement plan. It helps employees save for and invest in their retirement in a tax-advantaged way.

When you sign up to participate in a 401(k), you opt to have a specific percentage of your paycheck automatically directed into the plan. Your employer has the option to

Which 401(k) plan is right for me?

Like all other types of investments, 401(k)s fall into an income tax bucket of either

Traditional 401(k) plans are funded with pre-tax dollars

Among the range of 401(k)s, traditional 401(k) contributions are the most common. These plans fall into the "tax later" category, as they are funded with pre-tax dollars through payroll deductions during your working years, but then are taxed at your ordinary rate once you withdraw the money in retirement.

Roth 401(k)s are funded with after-tax dollars

Your employer also may offer an option to contribute to a

Once it's time to take out money in retirement, you won't be taxed on your contributions since you already paid taxes upfront. And, if you follow the IRS's qualified withdrawal rules, the earnings are "tax never", so you never will need to pay money on that growth.1

Other types of 401(k) plans

Aside from the standard 401(k), the IRS allows for some variations suited to specific needs.

- Solo 401(k): If you are a business owner and have no employees, you can contribute to a

solo 401(k) , also called a self-employed 401(k) or individual 401(k). A solo 401(k) is limited to business owners and spouses. It's otherwise similar to a traditional 401(k).

- SIMPLE 401(k): The SIMPLE 401(k) is a less common type. Small businesses with employees may choose it as a more streamlined alternative to administering a traditional 401(k).

Am I eligible for a 401(k)?

You can contribute to a 401(k) plan if your employer offers one and if you meet your employer's eligibility requirements. A federal law called the

The documents you received when you accepted your job should explain the benefits your company provides, including a retirement savings plan. If you're unsure, ask your coworkers, your boss or your human resources department. If your company has an online employee benefits center, you may be able to get the information you need by logging in.

Every company that has a 401(k) plan is responsible for offering a formal document called a summary plan description detailing the plan's rules, including who is eligible to contribute. Save a copy of this document to reference later.

One common eligibility requirement involves working for the company for a certain amount of time. For example: If you're a full-time employee, you could have to work there for six months before you're allowed to contribute or receive an employer match. If you're a part-time employee, you may have to work an average of 20 hours per week or another minimum to be eligible.

4 benefits of 401(k)s

If you're eligible for a 401(k), here are four benefits of why it pays to participate.

1. Matching employer contributions

Many employers match a portion of your contributions via employee matching contributions, and some may even contribute money to your 401(k) whether you do or not in what are called non-elective contributions. To get the most out of your plan, get to know your employer's matching policy.

Let's say you make $100,000 and your employer offers a 5% match. If you have 5% of your pay ($5,000) withheld from your paycheck and put into your 401(k), your employer also may put $5,000 in your account. You'd then have a total of $10,000, which means you're effectively saving 10% of your salary for retirement. That's like getting 100% return on your investment.

2. Tax-deferred growth

The time-delayed, tax-advantaged aspect of 401(k)s is what makes it such a powerful retirement tool. Say your account value increases from $1,000 to $1,100 from January 1 to December 31—the $100 increase is not taxable. If you experienced the same gain in a standard investment, like a mutual fund, it would be taxable.

Tax-deferred growth helps your account balance grow far larger than the same contributions could in a taxable account. Whichever type of 401(k) you contribute to and whichever type of contributions you make, tax-deferred growth can help you generate more money for retirement.

3. Compound interest: The power of time

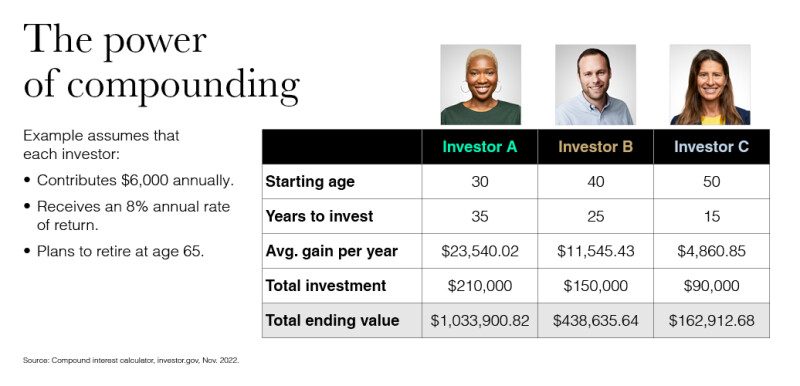

Compound interest also helps your money grow over time. With compound interest, your earnings grow based on your original investment and interest earned. In other words, the interest you earn each year gets added to your account balance. Then, the next year's interest is calculated based on the new, larger balance, so your earnings grow at an accelerated rate.

Simply, the earlier you start saving in a 401(k), the more time compounding has to work its magic.

4. Generous contribution limits

401(k) plans have high annual contribution limits. If you're 50 or older, you also have the option to make

2025 employee 401(k) contribution limits

- Employee contribution limit: $23,500

- Catch-up limit: $7,500

2025 combined employer & employee 401(k) contribution caps

An employer can contribute even more to your 401(k), for a total possible contribution of:

- 2025 combined contribution limit: $70,000 ($76,000 for age 50 or older), or 100% of your salary, whichever is less

Starting in 2025, participants turning 60, 61, 62 or 63 during that calendar year can do the regular catch-up plus an additional amount limited to $10,000 or 150% of the dollar amount.

3 potential drawbacks of 401(k) plans

Before you contribute to your 401(k), keep in mind that there are some potential drawbacks:

1. Withdrawal restrictions

Once you contribute money to a 401(k), it can be difficult to access those funds before you reach age 59½. Some plans include options to

Some plans allow you to take a type of early distribution called a

Given these restrictions on withdrawing money before you're 59½, it's crucial to find that sweet spot—contributing enough to meet your retirement goals but not so much that you'll have problems meeting your expenses before retiring.

2. Investment options may be limited

Once you make a contribution, you may be limited to a preselected menu of investment options. These investment options typically include things like

For many people, not having to choose from the entire pool of investments the market offers can be a good thing. But some more experienced investors may prefer to have more options.

3. Required minimum distributions (RMDs)

An

- If you turn 73 before 2033, your RMD age will be 73.

- If you turn 74 after 2032, your RMD age will be 75.

If you're still working at your RMD age and your plan allows it, you may be able to delay taking RMDs.

While the traditional version of 401(k)s will be subject to RMDs, starting in 2024 Roth 401(k)s will not be subject to RMDs.

Some people may feel limited by RMDs requirements because they may not need to withdraw as much to cover their expenses as the IRS requires. They'd prefer to keep the money in the account where it can continue to grow tax-deferred.

How to contribute to your 401(k)

If you're not already enrolled, you can begin at any point during the year as long as the employer allows and you're eligible to participate. Ask your company's human resources department how to sign up. Then, create your account on the plan administrator's website so that you can easily manage your contributions and investments.

Some companies

If you've been enrolled automatically, you'll see the deductions on your pay stub. However, you may want to change your contribution rate or how your money is invested. You can do this by logging into your account through your plan administrator's website. You also can use the website to characterize your contributions as traditional or Roth and determine what percentage of your paycheck goes to each type of contribution.

How to withdraw money from your 401(k)

You must meet specific requirements to take distributions. The requirements will depend on what the plan document allows, the type of distribution you're taking (i.e., qualified vs. early) and whether you still work for your employer or not. To take a distribution, contact your plan administrator—the financial services company whose name is on your account statements. You can make your request online, by phone or by mail.

Each plan has requirements that must be met in order to allow a distribution to be sent directly to you. If your request is approved, they'll send you the money by check or direct deposit. If applicable, they will withhold taxes and remit them to the IRS. If you're borrowing from your 401(k), they'll manage your loan repayments.

When you

42% of people nearing retirement intend to rely on a mix of assets such as a 401(k), personal savings, Social Security benefits and IRAs.

Is my 401(k) enough for retirement?

If you can afford to do so, it's a good idea to not solely rely on your 401(k) to fund your retirement. In fact, Thrivent's Retirement Readiness Survey3 found that among those nearing retirement, 42% intend to rely on a mix of assets such as a 401(k), personal savings, Social Security benefits and individual retirement accounts (IRAs).

Explore supplementing your 401(k) savings with

If you do have more than one retirement account, evaluate how your accounts collectively protect you against (or overexpose you to) various tax risks—something a financial advisor can help with.

Get professional guidance on your retirement savings plan

A 401(k) helps you build a foundation to shape your retirement as you'd like it. Are you ready to contribute or unsure what your next move should be?