Most people want to know the best way to save for retirement, thinking it's a simple, clear-cut answer. But there's no single way to ensure you have the right amount of money saved up for your future. This is because a good retirement savings plan will include multiple sources of money to replace your employment income, and will take into consideration your ideal retirement lifestyle.

Understanding where your retirement income might come from will help you plan ahead to increase that figure. Visualizing the full picture of your future financial life in retirement can help you make smarter long-term decisions today.

In this article, we'll take a closer look at the best ways to

The three-legged stool of retirement planning

There are three main income sources for retired people. Think of these as a three-legged stool of sources to provide a stable income for your retirement.

1. Investments.

These can include your retirement savings plan (such as an

2. Social Security.

The great news about Social Security is that it is one of the few sources of income you can't outlive. And, while most American workers qualify for Social Security income in retirement, you shouldn't assume that you can enjoy a comfortable lifestyle on these benefits alone. As of 2023, the average Social Security benefit for retirees was about

Social Security is a complicated aspect of retirement planning. The amount of benefits that you receive from Social Security will depend on how long you work, your income while working, your marital status and spouse's Social Security benefits, when you plan to start

3. Other guaranteed income sources.

In addition to Social Security, you might have other sources of retirement income, like a

Fully understanding the sources of your future retirement income can help you assess where you stand currently and see the gaps that you will need to fill before you retire. Even if retirement is many years away, planning ahead is always best. If you start saving early, and smartly, you can turn some of these options into consistent income that will last the rest of your life.

Ways to start planning for retirement

Put money into your 401(k) or other tax-advantaged retirement savings accounts

If your employer offers it, you can use a

You might also want to use a

Pay attention to your Social Security account throughout your career

You can set up and view your personal Social Security account at

Some people are worried that Social Security won't be around when it's time to retire. This has led to misunderstandings and fears about the solvency of the Social Security system.

With the current reserves, the system will be able to pay 100% of promised benefits until 2034. After that point, they project

It seems unlikely that Congress would force retirees to take a 22% benefits cut. But the uncertainty facing Social Security reserves is another reason you should save as much as you can for your own retirement goals.

Consider working in other types of guaranteed income sources

Depending on your financial goals, annuities can be a good option for guaranteed income in retirement and are one of the few investment solutions that ensures you won't outlive your money. With an annuity, you set up a contract with an insurance company or investment management company where they convert your lump sum of savings into a steady retirement income. Learn more about the

Some people might also have pension income from their careers. Pensions are a form of a defined benefit retirement plan, where employees are guaranteed a certain specific benefit amount based on their income and years of service to the employer. Although traditional pensions have become less common in the private sector in recent years—with only

Staying on track for retirement savings goals

Once you understand the three-legged stool concept and where your retirement money will come from after you retire, think about how you can stay on track with your retirement savings goals. Start by understanding the ballpark of what you will need for retirement income by using the

Then, make a budget to ensure you can meet your savings goals. Use a budgeting app or even pen and paper to make a clear list of how much you spend each month and on what. Ask yourself: How much money do you need to keep your current lifestyle? Where could you cut back spending to make more money available for retirement contributions?

Here are a few more tips for smart savings:

Adjust or review your investment risk tolerance

Understanding your own personal

There's no one combination of the right blend of investments to have in your retirement savings portfolio. It depends on your age, your income, your total savings rate, how much income you hope to have in retirement, and your overall risk tolerance.

For example, if you still have 30 years until retirement, you might feel comfortable investing in a portfolio that has a higher percentage of stocks instead of bonds and cash. Riskier investments in the short term might give you a better chance of long-term growth. But if you don't have as much time left before retirement age, depending on the size of your retirement portfolio, you might need to consider a less-risky blend of investments to protect the wealth you've built so far.

Use tax-efficient strategies

Another aspect of retirement investing is

If you're concerned about tax-efficient strategies, talking to a Thrivent financial advisor can help. While Thrivent does not provide specific legal or tax advice, we can partner with you and your tax professional or attorney. Your tax situation in retirement might be different than when you were working. Depending on your income and tax bracket, there might be opportunities for you to be strategic about when and how to take distributions from your tax-deferred retirement accounts, which investments to hold or liquidate, and how to make charitable contributions for maximum tax benefit.

The ultimate guide to retirement savings by age

Watch out for these retirement saving roadblocks

It's important to keep saving and investing for your future—every paycheck, every month. However, life is complicated, and people sometimes experience financial challenges or events that interrupt their plans. Watch out for some of these common obstacles that could impact how much you're able to save:

- Job loss. If you lose your income, if your industry is in decline or if your skills are not adaptable to the changing needs of your profession, your retirement could be at risk. Keep upgrading your skills and building your professional network throughout your career. Look for ways to gain new professional certifications that can help you advance and earn a higher income.

- Credit card debt. If you have high-interest

credit card deb t or other consumer debt, make a plan to pay it down.

- Real estate purchase. If you buy a house that costs more than you can comfortably afford, your monthly mortgage payment might cut into the amount you can save for retirement. You might consider staying in your "starter home" for a few years longer than you had planned. This can free up more money in your budget.

- Auto loan. Taking out a loan for your car or truck is often considered "good debt." But if you're paying too much money in monthly auto loan payments, your retirement savings goals might get left behind. Resist the temptation to buy or lease a new car every couple of years. This could help you invest hundreds of extra dollars a month.

- Health problems. Having to miss work for several months or longer because of severe illness or injury can harm your retirement savings and your income potential. You may be able to protect yourself from the full financial burden of health problems with

disability insurance .

- Divorce. Ending a marriage can cause your retirement savings to take a big hit. If you go through

a divorce , you might take the opportunity to reshape your financial strategy and save more aggressively for retirement.

If you come up against one of these roadblocks, build back to healthy retirement contributions slowly. Even if you can only afford to save a small percentage of your income, start with that amount. Each year, try to increase your retirement contributions by another small percentage of your income or more when you can.

You also can push any financial windfalls toward your retirement accounts to catch up. If you get a pay raise, put it into retirement savings if you can. If you receive a tax refund, an inheritance, a gift or proceeds from a business or property sale, put some (or all) of that one-time money into long-term retirement savings.

The best way to save for retirement is to start early

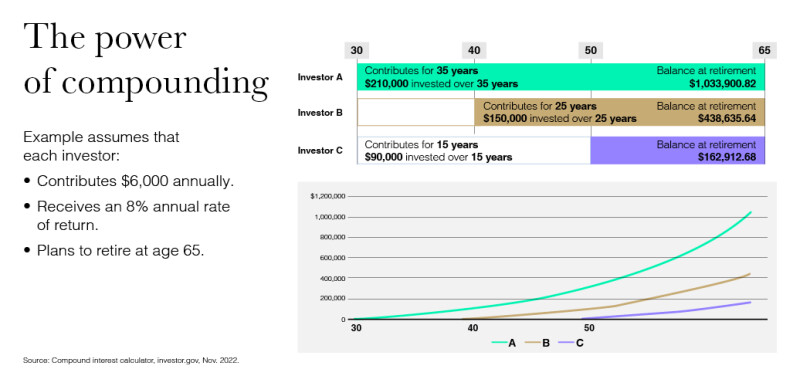

How much you're able to save for retirement depends entirely on your unique financial situation. But if you're able to start saving early, you will likely be in a better situation when you leave the workforce. Your money will have had more time to grow and experience the power of compound interest. The earlier you start saving, the more time your money has to grow, with your investment gains earning additional interest year after year. Taking several years off from saving for retirement could cost you hundreds of thousands of dollars of investment growth.

Get professional guidance on your retirement plan

Although there is not one single account or method or portfolio that's "the best" way to save for retirement, the best tactic is starting early. Connect with a