As you plan and save for retirement, deciding when you’ll take Social Security is one of the most important financial decisions you’ll make. And typically, once you start taking benefits, you won’t be able to stop them (though there are

1. Your full retirement age (FRA)

Full retirement age (also known as FRA or “normal retirement age”) is when you’re eligible to receive your full Social Security benefits. That’s 66 if you were born between 1943 and 1954, and it gradually increases to 67 if you were born in 1960 or later. After that, you’ll earn an extra 8% for each year you delay filing up to age 70. Though that isn’t always an option for everyone.

What’s your full retirement age?

| If you were born in: | Your full retirement age is: |

| 1943–1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

Claiming Social Security early

You can claim your own Social Security as early as age 62. But your retirement benefit will be reduced if you take it before FRA. If you’re within 36 months of that, your benefit is permanently reduced five-ninths of 1% each month before FRA. Retire sooner than that and your benefits are further reduced by five-twelfths of 1% for each additional month (5% per year).

Andrew Mortenson, a Thrivent financial advisor in West Bend, Wisconsin, says he often meets with clients who wish to claim Social Security at their earliest opportunity. But it’s important to sit down and assess the pros and cons within each individual’s circumstance.

“We walk clients through a process,” says Mortenson. “We determine what you want in retirement and why. We take the time to understand your income needs, as well as different options to fill the income gap that occurs at retirement. Social Security planning, tax planning, investments—they’re all tied together. They’re pieces of your puzzle.”

Early retirement Social Security example

The

Delaying Social Security

By contrast, there are perks to delaying Social Security past your FRA. You may earn delayed retirement credits (DRCs) for your own benefits (but not spousal benefits).

For every year you wait to start your benefits after your FRA (up to age 70), you may be eligible for an 8% credit.

Late retirement Social Security example

Let’s again figure an average monthly Social Security retirement benefit of $1,907 and an FRA of 67. If you wait until age 70 to claim, your benefit amount will be 24% higher (8% credit x three years)—bringing your monthly benefit to $2,364.68. That’s $5,492.16 more each year.

It can be a six-figure difference for you and your family. It really matters.

2. Your marital status & family situation

Whether you’re married, divorced, widowed, single or still caring for children—there may be special eligibility rules and considerations to weigh for maximizing your Social Security benefit.

Social Security benefits & strategies for married people

Thanks to spousal benefits, you can collect Social Security benefits on your own earnings or up to 50% (less if you’re not yet FRA) of your spouse’s FRA benefits—whichever is greater. That’s if:

- You’re 62 or older (earlier if you care for a child under age 16 or an adult child with special needs, who’s receiving Social Security disability benefits).

- You’ve been married to your spouse for at least one continuous year.

- Your spouse is collecting their Social Security benefits.

Thrivent clients Mary and Blaine Peterson chose a split strategy for claiming their Social Security benefits.

Thrivent clients Mary and Blaine Peterson chose a split strategy for claiming their Social Security benefits.

You’ll also be eligible for survivors benefits if your spouse dies.

If there is a significant difference in earnings between spouses, married couples often consider a staggered or split Social Security strategy—where each person claims at a different age.

“Generally speaking, we recommend delaying the higher earner’s benefit until at least full retirement age—ideally to age 70,” says Eric Berg, Advice Services consultant at Thrivent. “That gives you some flexibility to claim the lower benefit if more income is needed sooner.”

Using a split strategy allows more time for the higher earner’s retirement benefits to grow, as well as the couple’s survivors benefits. That’s why Mortenson recommended a split strategy to Thrivent clients and middle school sweethearts, Mary and Blaine Peterson. Together, they decided to draw Mary’s Social Security at age 62 and wait to claim Blaine’s benefit at his FRA of 66.

“It’s reassuring to know that when one of us dies, the other will be financially fine. They won’t be burdened,” Mary says.1

Deciding when to take Social Security is a combination of logic and emotion. While we can tell you that 70 is the magic age, it isn’t always. It’s what’s right for you.

Social Security benefits if you’re a widow or widower

If your spouse has died, you still may be eligible to receive up to 100% of their retirement benefit (less if you’re under FRA) if:

- They worked enough to qualify for retirement benefits.

- You wait until full retirement age to claim.

- You don’t remarry until after age 60 (or age 50 if you’re disabled).

You also have the option to claim survivors benefits and wait until full retirement age or any time up to age 70 to switch to your own benefit, so it has time to grow.

Social Security benefits if you’re divorced

If you’re divorced, you still may be able to receive spousal benefits once you’re at least age 62 if:

- You and your ex-spouse were married for 10 or more years and divorced for at least two continuous years.

- You’re not remarried, or you did so after age 60.

- Your ex-spouse is old enough to claim Social Security.

Your decision to claim on their record does not affect their benefit—and they won’t be notified of your election. Their age, filing status and marital status also will have no bearing on your benefit.

If your ex-spouse has died, you still may be able to receive up to 100% of their Social Security benefits if you begin collecting survivors benefits at your FRA (less if it’s earlier than then).

What to know about Social Security if you’re single

Since you aren’t accumulating assets with another person, your decision to delay or claim Social Security benefits solely will depend on how much other money you have, when you plan to retire and how long you expect to live. You won’t have to worry about delaying for the sake of optimizing spousal benefits or survivors benefits.

Social Security if you’re raising children

Up to half of your Social Security benefits—or your spouse’s—may be payable to your children, stepchildren (if you provide at least 50% support) or dependent grandchildren if they are under age 18. However, they still may qualify if they are 18 or 19 and in high school. Or if they were disabled before age 22.

3. Your other retirement income sources

Your paycheck may have been your only source of income during your working years, but in retirement, you’ll likely tap into

Annuities. Pensions. IRAs. - Employer-sponsored plans, like

401(k)s and 403(b)s. Brokerage accounts. Savings accounts. Certificates of deposit (CDs).

Using some of these other savings can help you bridge the gap until you reach FRA or age 70. “We recommend spending a little bit of your assets up front so that later, you may not have to tap into them hardly at all,” says Mortenson.

Blaine chose to begin receiving monthly payments from his pension to bring in some income while he waited to reach FRA. Now that he’s claimed Social Security, he and Mary (both age 69) have had to draw very little from their other resources.

“My retirement savings are just sitting there,“ Mary says. “I pull nothing.”

4. Your health & life expectancy

In addition to your marital status, your health status and longevity are other key factors in deciding when you’ll take Social Security.

“If you knew when you were going to die, it would be easy,” says Berg.

And while that can be an uncomfortable topic to think about, Berg says it’s important to start with the facts:

- Are you a smoker or non-smoker?

- How would you currently rate your health?

- What’s your family health history?

The

How Social Security may affect your Medicare

If you decide to retire before 65, you’ll lock in a lower Social Security benefit and may need additional funds to tide over your health insurance before you become eligible for Medicare. Just keep in mind that once you do qualify, you could face a higher Medicare premium if your modified adjusted gross income (MAGI) falls above a certain

“Not all investments are created equally,” says Mortenson. “While Social Security payments increase your MAGI, not all distributions from other investments do. As a financial advisor, we always look to offer that clarity as it relates to your own investments.”

5. Your break-even point

Similar to your full retirement age, another important age to keep in mind is your Social Security break-even point—when the total benefits you’d receive from collecting Social Security earlier (at a reduced amount) becomes equal to the total benefits you would’ve received if you’d delayed taking them. That’s typically somewhere between ages 78 and 81.

“Some people would rather be cumulatively ahead in the earlier years than cumulatively ahead in the later years,” explains Berg. “While I’d personally rather be ahead before age 80 than after age 80, if I think I’m going to live to 90 or 100, it still may be best for me to delay.”

Break-even point example

Let’s say you delay taking benefits until your 70th birthday. At our previously used benefit amount of $2,364.68 (a PIA of $1,907 plus a 24% DRC for waiting three years after your FRA of 67), you’ll reach your break-even point at age 80 years and 5 months (after 125 months total), at which point, you’ll have received a total of $295,585 in benefits. That will be the first month that sum exceeds the total amount of payments you would’ve received if you’d began drawing the reduced benefit ($1,334/month) on your 62nd birthday. 221 months in, you’ll have received $294,814.

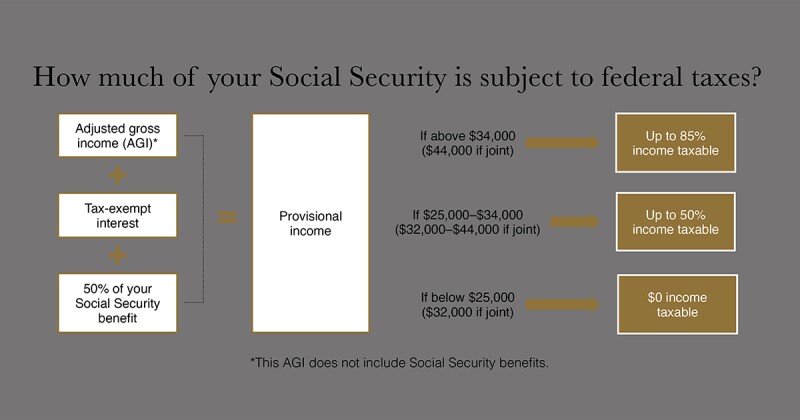

6. Your tax implications

For the most part,

That’s why tax diversification is of the utmost importance. For instance, you may wish to draw from tax-never (tax-free) accounts like

On the other hand, tax-later accounts like a traditional 401(k) or IRA, can be great retirement income sources to tap into while you wait to claim Social Security, says Berg. Since you already received a tax break when you put the money in, 100% of those withdrawals will be taxed as federal income (state taxes may vary). They’ll also fall subject to

“Your money is either going to the people you care about, the causes you care about, or the IRS,” Mortenson says. “That’s why we look for ethical ways to help reduce the taxes you owe in your lifetime.”

Get an expert opinion

Electing to take your Social Security benefits is not a decision to take lightly. That’s why it’s important to not go it alone. A

“Deciding when to take Social Security is a combination of logic and emotion,” Mortenson says. “While we can tell you that 70 is the magic age, it isn’t always. It’s what’s right for you.

“Let someone sit down with you—or at the very least, pick up the phone and call—so you can truly see Social Security in light of the broader picture,” he continues. “It can be a six-figure difference for you and your family. It really matters.”

In the case of the Petersons, the impact of that conversation was more than material.

“We don’t hold back. We don’t say no to trips. We don’t say no to new vehicles,” says Mary. “We have more opportunities knowing we’ll be OK.”